Russia Warns of $300 Oil

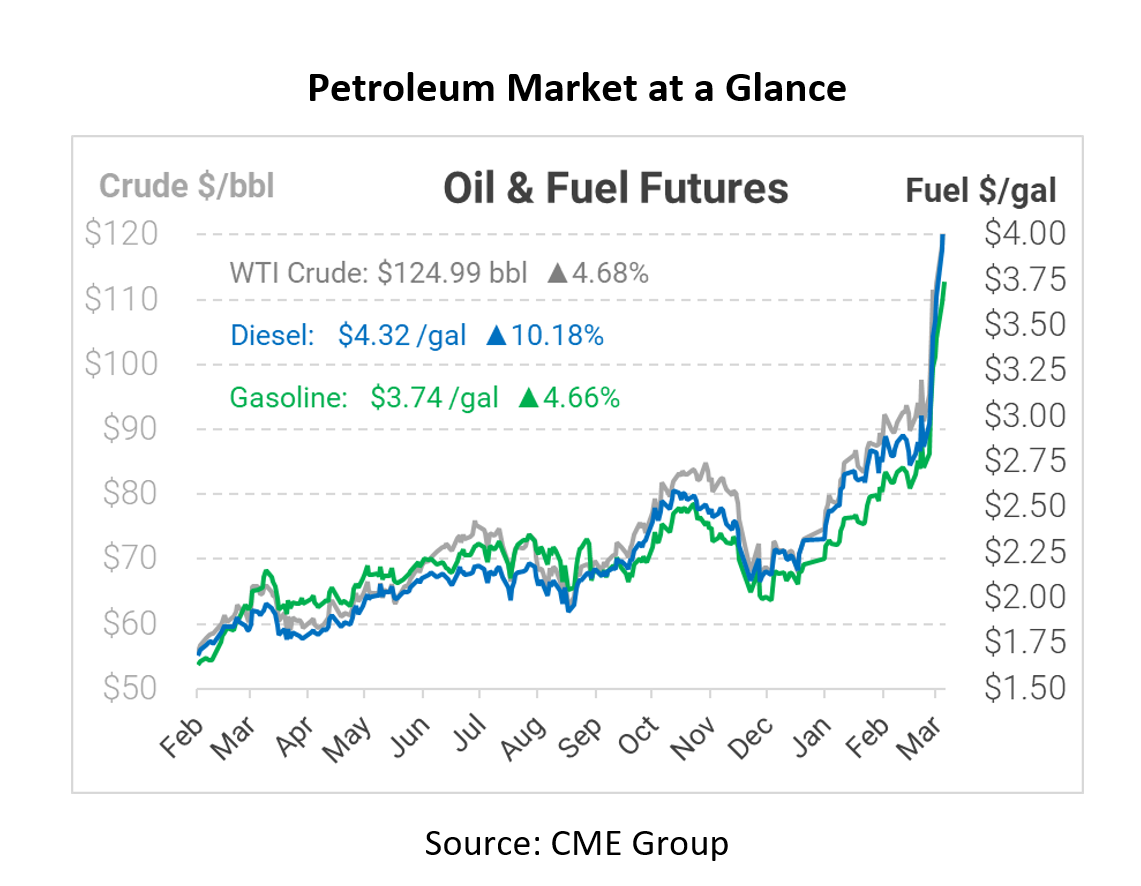

Today oil prices are up as the implementation of a Russian oil ban is almost complete. Crude prices have risen as high as $126/bbl, with diesel and gasoline also spiking. This news of the Russian oil ban is not taken kindly by the Russians, who now say the West could face $300/bbl due to the new sanctions.

Since the start of the Russian-Ukrainian conflict, consumers have seen historical price spikes and the highest oil prices since 2008. Since the invasion began, the West has continually warned Putin and his regime of severe sanctions that would take place, and it looks like it is finally happening. The U.S. and its European allies are seriously considering the complete ban of Russian oil imports this morning, something the Russians are not fond of. While such a ban could lead to severe global economic consequences, it seems like this is one of the most severe messages the West can send.

Russian Deputy Prime Minister Alexander Novak is urging the U.S. and its allies not to move forward with the ban and that it would take “Europe more than a year to replace the volume of oil it receives from Russia.” The Russian government has also welcomed the ban by saying “go ahead and do it” and that they would “re-direct the volume somewhere else,” a concerning response for a country under the watch of every major world power as they invade a peaceful country. In another defensive effort, Russia has warned of an embargo on gas pumping through the Nord Stream 1 pipeline. They have made it clear that they are not acting on this yet, but that European politicians are “pushing us toward that decision” if the current trajectory of Russian oil bans continues. Nobody knows what will happen for sure, but the Russian-NATO chess game plays on.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.