Supply Concerns – At Home and Abroad

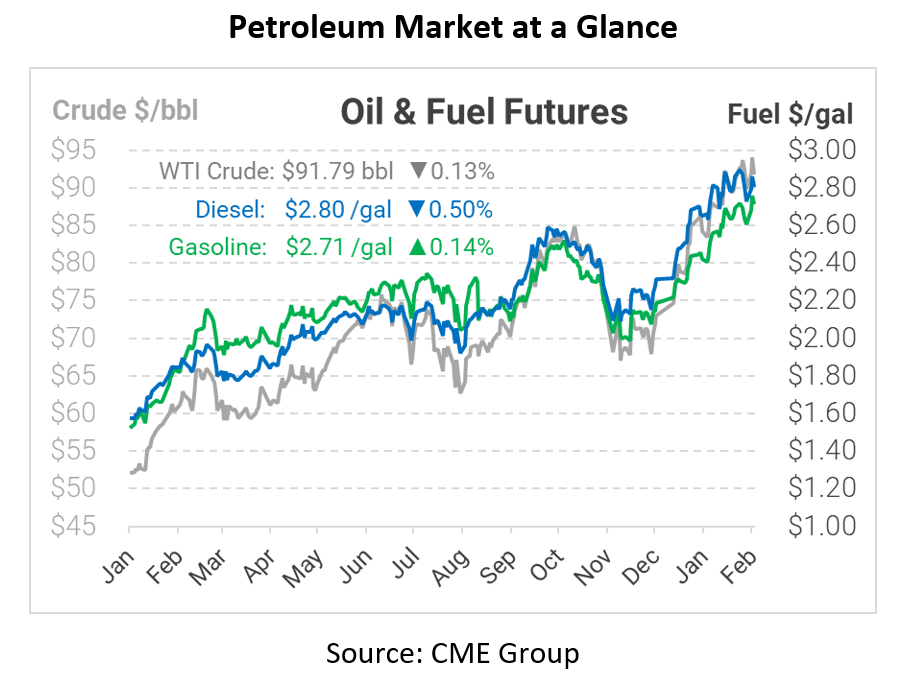

Yesterday prices went through several gyrations, though ultimately fuel prices went from being up a dime to just 3 cent gains by the end of the trading session. Volatility is expected, given major geopolitical actions beginning at the Ukraine border. Labeling yesterday’s actions as “the beginning of a Russian invasion,” President Biden added fresh sanctions on Russia, targeting Russian officials and financial instruments. Prices have traded sideways this morning, going from moderate losses to small gains as time progressed.

As markets continue focusing on international tension, fuel disruptions are occurring much closer to home as well. A major refinery in Louisiana experienced an explosion on Monday, injuring several workers and knocking out the plant’s diesel-producing hydrocracker. The refinery, capable of producing over half a million barrels (21 million gallons) of fuel each day, has not reported how the explosion and fire will impact production, though market analysts expect that diesel production may drop through March.

So far, markets have been slow to respond to the news, but it’s possible that Gulf Coast diesel prices could rise in the coming days as more details are released. Bloomberg reports that currently, 10% of Gulf Coast refining capacity is offline for repairs, so markets may have already priced in the effects of limited local supply. Although the local supply event may increase prices by pennies, the biggest moves this week will certainly come from international headlines, whether that’s the Russia-Ukraine situation or the US-Iran nuclear deal. Stay tuned!

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.