Russian Invasion Halts Nord Stream 2 – What It Means for Oil

It’s happening.

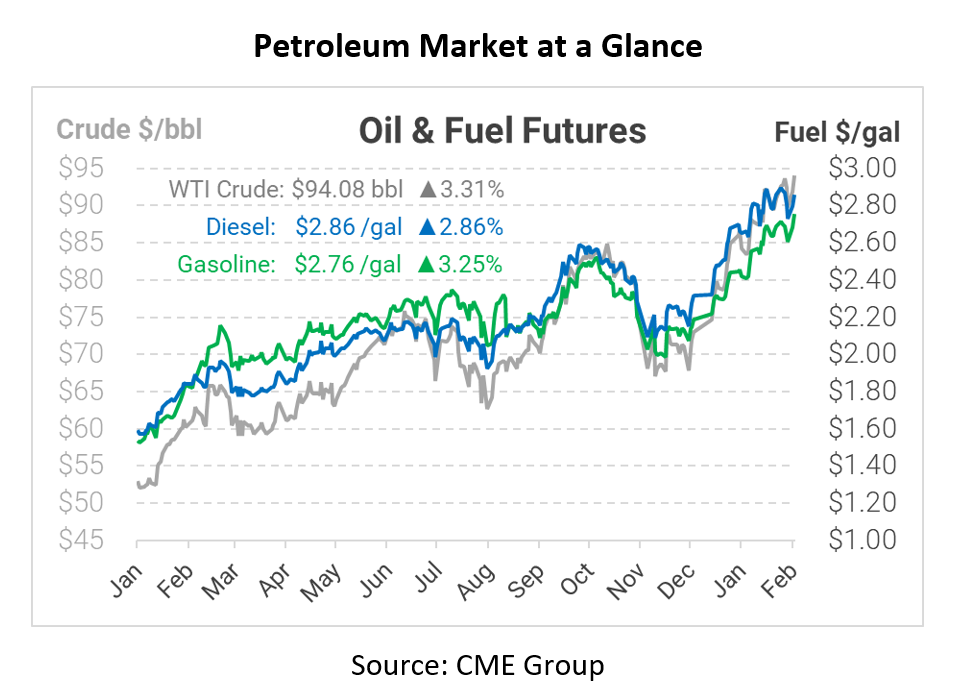

After weeks of uncertainty, Russia has moved troops into eastern Ukraine, deeming those areas independent territories. The West is responding with limited sanctions, reserving stronger sanctions for more overt actions from Russia. Fuel prices are surging nearly 8 cents per gallon this morning.

One country has unilaterally shown how severe the cost of invasion could be for Russia. Germany announced they are halting certification of the Nord Stream 2 pipeline, a blow to Russia’s energy-based economy.

What is Nord Stream 2?

Nord Stream 2 is a natural gas pipeline running from Russia directly to Germany, laid beneath the Baltic Sea. The pipeline was completed in September but has remained offline pending German certification. The pipeline can transport 55 billion cubic meters of gas per year – over half of Germany’s entire natural gas demand. Certification was not expected to be completed until summer of 2022.

Nord Stream 2 runs parallel to the Nord Stream pipeline, which has been operational since 2011. Together, the pipelines would be capable of supplying a quarter of the EU’s total natural gas demand – giving Russia the ability to significantly control the EU’s energy supply.

Why is Nord Stream 2 Controversial?

The US has long opposed the pipeline, warning that it would extend Russia’s influence over the EU. Russia is already a major supplier of energy to the EU, and the pipeline would extend their influence by pushing their supply further west. Already, Russia has been limiting existing flows of natural gas to the EU; analysts warn a complete cutoff is possible as sanctions escalate.

If Nord Stream 2 Delivers Gas, Why Is This Important for Oil?

Shutting the pipeline is most immediately impactful for natural gas markets, but also significantly impacts oil supplies. When natural gas prices rise too high, many power companies switch fuel streams to using oil products, typically middle distallates that trade off with diesel supply. Already, a cold winter and low inventories have put pressure on Europe’s oil markets.

If Russia does cutoff Europe’s natural gas supply, many markets would be forced to switch to heavy fuel consumption, rapidly depleting the world’s limited oil supplies. Moreover, those companies also purchase oil from Russia, so their petroleum supplies are at risk as well.

With Germany putting energy on the table as a weapon, it’s possible that both natural gas and oil supplies could be cutoff, leaving the rest of the world to figure out how to keep Europe fueled and powered.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.