Biden Oil Policies Bite Back

The past few months have not been great for President Biden as recent polls show his approval ratings have dropped to a new low of 41% – a dangerous sign for his supporters. With consumers paying more for gasoline now than they have in years, the oil and gas sector has been particularly hard on him as of late.

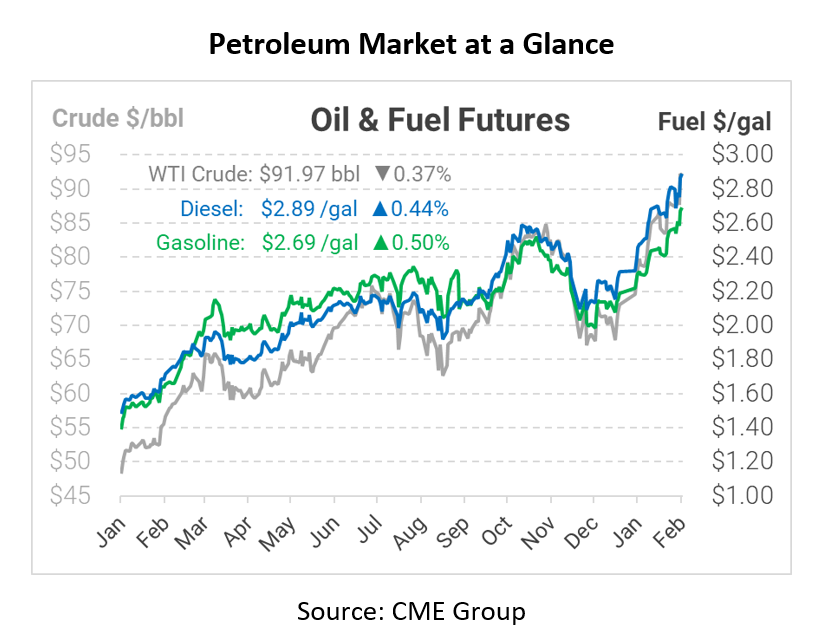

With oil demand hitting 7-year highs of $90/bbl last week, the outlook for oil prices continues to be bullish. As travelers hit the roads once again in the new “toned-down” COVID-19 world, oil producers are struggling to keep pace with the constantly rising demand for refined products. This reality is landing especially hard in Washington, D.C., where anti-energy policies are starting to look more and more ineffective. Disruptions of the supply chain are ongoing, and gas prices at retail stations are averaging more than $3.41 per gallon. With prices for gasoline climbing upwards of 58%, the question about what relief – if any – the market will provide is becoming more and more pronounced. Americans are traveling more each passing day, demand is poised to continue its current trajectory, and tomorrow’s prices will depend heavily on the supply side.

To make matters worse for the Biden administration, they have begun to backtrack on old policies and have asked shale companies to add more rigs and drills to their leases in a desperate attempt to correct the market. According to many of these producers, coming to them now in a time of need when they were all but cut-off by the White House is a “slap in the face.” The United States is enduring a time of record increases in consumer prices; now, the expectation is that the people elected to enact change will fix an exacerbated supply chain dynamic.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.