Looking Ahead – Oil Demand in 2022

On Wednesday the International Energy Agency (IEA) said that global oil demand could reach far past pre-pandemic levels sometime this year. This comes primarily due to the fact that recent virus variants are proving to be less deadly, and the immunization rates around the world are skyrocketing. These positives changes with COVID-19 are leading the charge for a more fruitful 2022 for oil demand.

When the new IEA report came out yesterday, it reflected its demand growth forecast by showing a 200,000 barrel per day (bpd) increase, totaling up to a new 3.3 million bpd number. With the IEA reflecting new numbers based on positive COVID-19 data, global economies could see a return to normal for oil demand in their regions within the year. While any one event could derail such a comeback for demand, the COVID-19 numbers and general stability of world economies since vaccines were introduced to the market are helping this forecast.

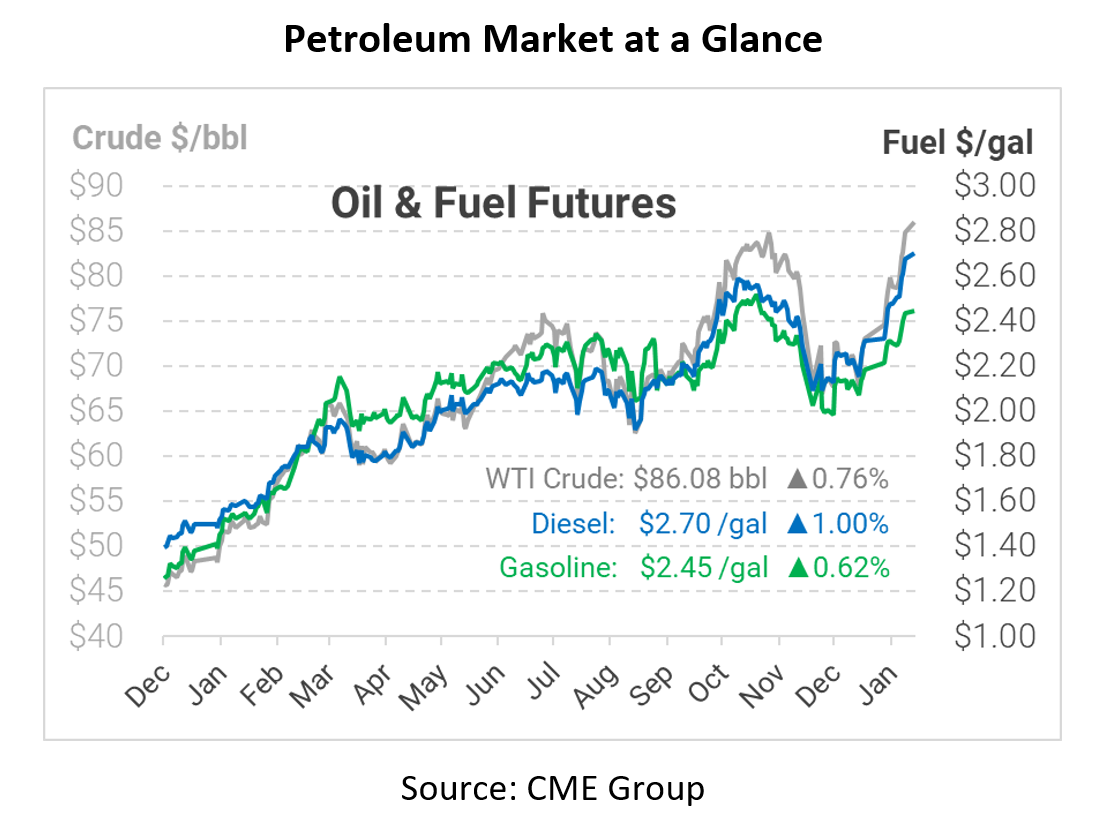

While demand seems to be on the up for oil, one concern for consumes is how the price of oil continues to rise. With the markets tightening as oil races toward $90/barrel, these price spikes are likely to lead to more drilling and production in the United States, according to the IEA. While most agree that demand seems to be on an upward trajectory for 2022, not all hold the same view as OPEC+ believes demand growth will remain unchanged for 2022.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.