Oil Nears $80/bbl – Technical Bounce or Fundamental Rise?

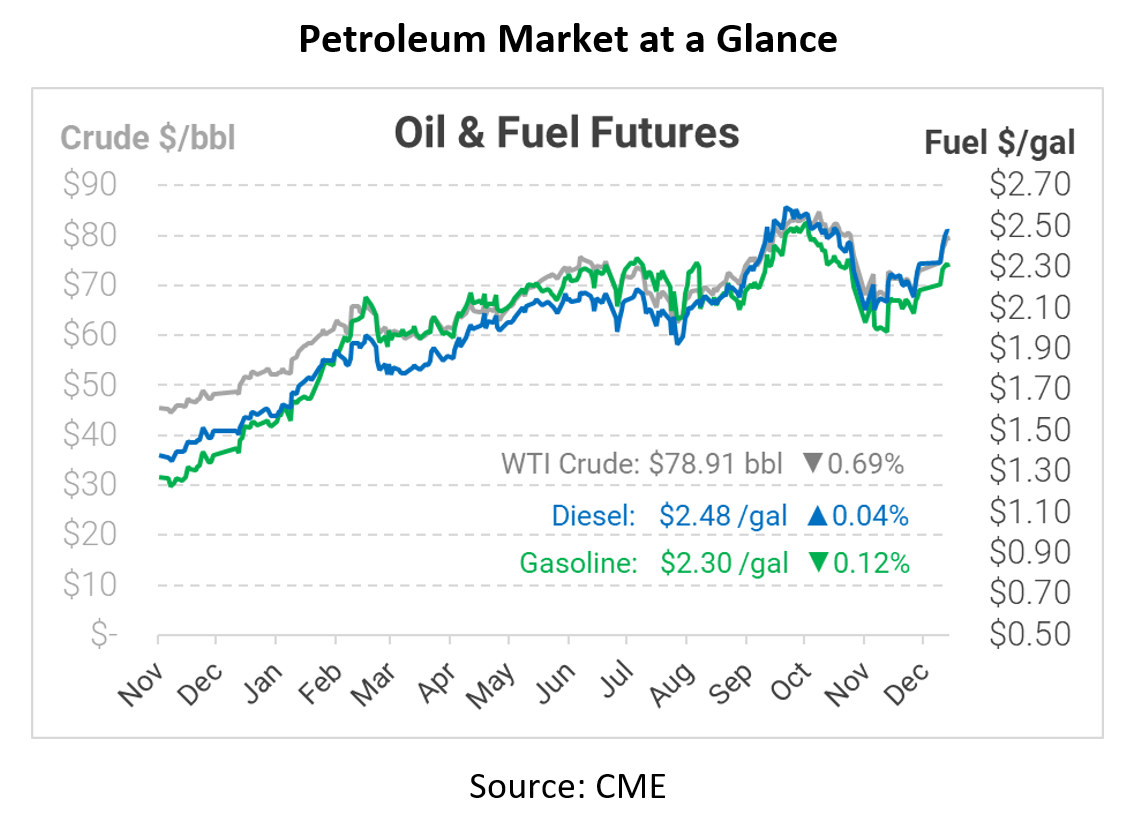

Fuel prices continue rising to new heights, with WTI crude nearing $80/bbl and diesel coming within a few pennies of $2.50 per gallon. The recent gains may feel a bit like the January Effect, which postulates that markets are re-buying positions sold in December for tax reasons. However, there are reasons to believe the rally is more than just a technical trading bounce.

Instability among major oil producers is stirring uncertainty for oil traders. Kazakhstan, which produces roughly 2 million barrels per day of crude oil, is spiraling, leading Russia to deploy troops to bring order. Although security forces seem to have restored order for now, one of Kazakhstan’s oil companies announced they were reducing flows in response to the violence. In addition, Libya has been the source of instability for weeks, causing outages at their main oil field. Together, these two threats have traders nervous about oil balances this year.

Adding to bullish pressure this week, the Labor Department reported that unemployment fell to 3.9% in December, the lowest level since the start of the pandemic. Although job growth failed to meet expectations, markets are enthusiastic at the low unemployment statistic, which was lower than expected. Of course, low unemployment statistics may also prompt the Federal Reserve to speed up their interest rate hikes, which would be bearish for equity and commodity markets.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.