IEA Reports Rapid Supply Growth in 2022

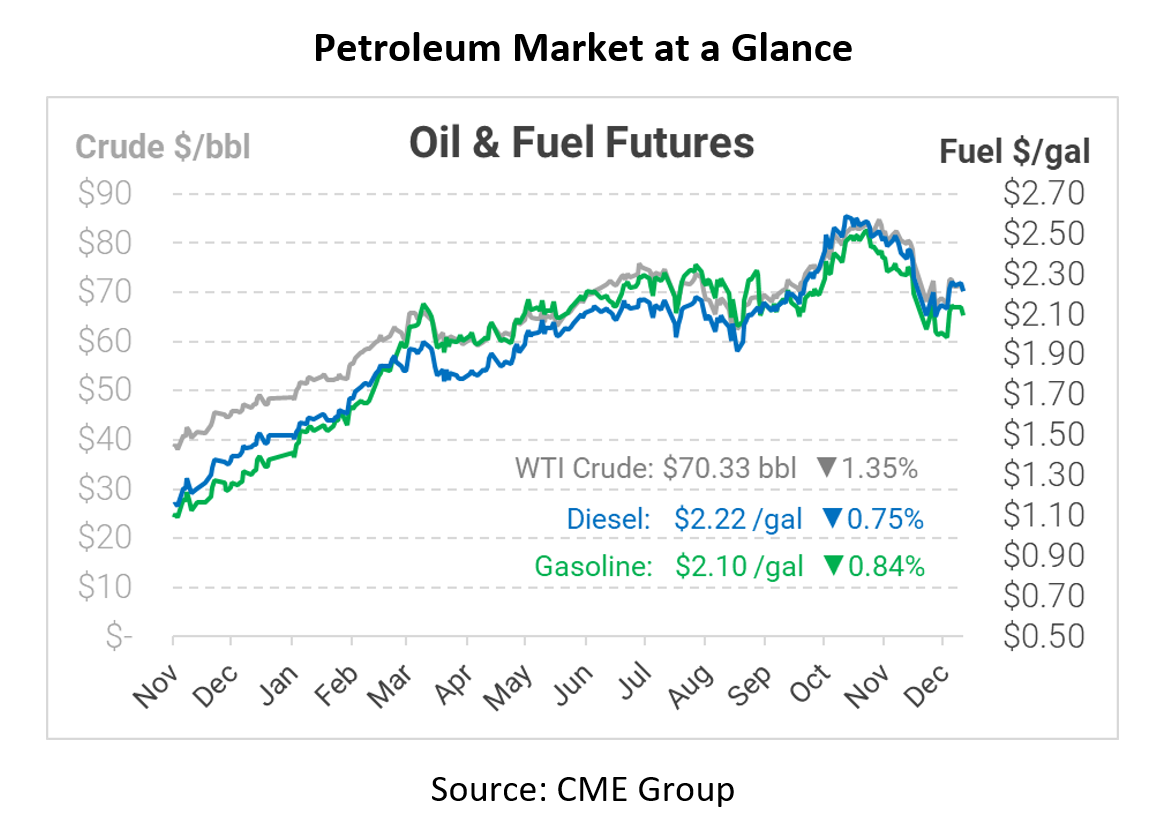

Markets are pulling back slightly this morning following the International Energy Agency’s (IEA) monthly oil report, which shows supplies rising even as oil inventories keep dropping. The group expects US supply will lead the way for a couple of months, with Saudi Arabia and Russia taking the lead in 2022 as OPEC+ unwinds its supply deal. In total, nearly 6.4 million barrels per day of supply will be added next year, significantly outpacing 2021 growth and driving oil prices lower.

After nearly two years of cratering US production, it seems oil companies are beginning to gain some confidence. The US’s Energy Information Administration (EIA) now predicts America’s most prolific oil basin, the Permian, to reach record production levels in January. US producers have prioritized the Permian because drilling there is faster and cheaper than conventional wells. On the flip side, Permian wells don’t always last as long, with yields dropping significantly over the first 18 months of the well.

On the demand front, the IEA expects global demand to continue rising in the future. Omicron presents a slight deviation from last month’s report, causing the agency to lower its demand forecast by a mere 100 kbpd. Specifically, the agency expects jet fuel demand to take a hit due to recently imposed travel restrictions.

The jet fuel revision is somewhat surprising against the backdrop of US jet fuel inventories, which fell this past week to the lowest level since 2014. Partially driven by rising demand, the drop is predominantly the result of low refinery output of jet fuel. Refiners have some small control over the ratio of gasoline, diesel, and jet fuel they produce. Since the pandemic began, jet fuel has been the lowest priority, while diesel has generally been the highest.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.