Oil Prices Climb as Omicron Hopes Emerge

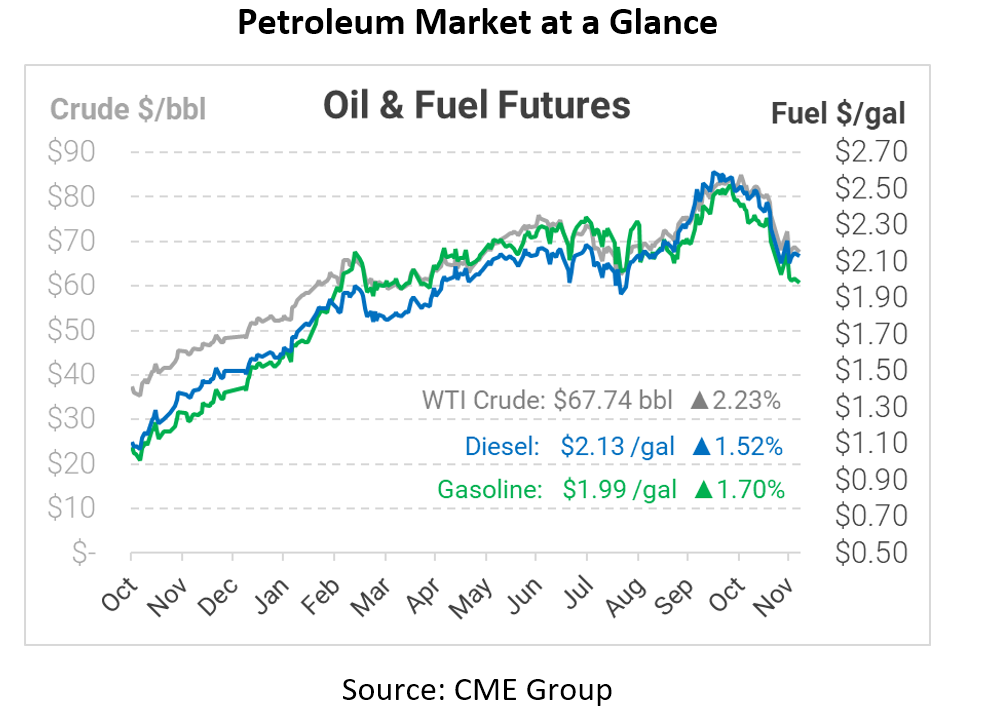

This morning crude opened at $67.02, climbing around $2. The market is rebounding after new developments show some positive momentum with Omicron research, leading many people to believe it could be less damaging to the overall health of the economy. Along with the impact Omicron is having on the market, news of Iran talks also hit mainstream media. This morning diesel opened at $2.1160 and gasoline at $1.9650.

This weekend, new evidence emerged with Omicron, showing that only mild symptoms are being seen around the world. This comes after many health officials suggested that this could be a more extreme version of COVID-19, so this has sparked positivity among much of the world’s top health researchers. In South Africa, health officials told top U.S. doctors that “it does not look like there’s a great degree of severity.” Scientists believe South Africa is a credible region to start in given the amount of Omicron variant infected individuals. Analysts also suggest that if Omicron does prove to be less severe and aggressive, then the lows experienced in the market last week were a “bargain of the quarter.”

In other news making oil headlines, the impact of Iran nuclear talks broken down last week continue to hover. While talks were indirect, it does not seem to be moving in the right direction after talks broke off for at least one more week. With anti-Western Iranian President Ebrahim Raisi, it seems as though it will be a while before things can once again be put on the table and discussed. Disappointment and concern now flood the political sector of the United States, as Americans will once again have to wait at least until mid-week before they hear more news.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.