We’re Back – What Happened Last Week?

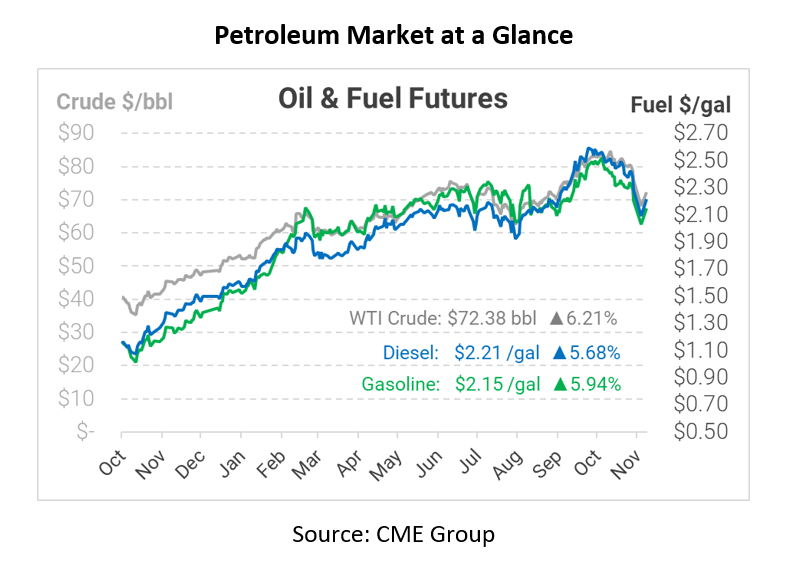

Friday was one of the most volatile trading sessions since the peak of the pandemic, and it seems appropriate that the major concern was the new Omicron COVID variant. Crude prices moved by an astounding $10 per barrel (-12.8%), while fuel prices sank nearly 30 cents per gallon. Today, markets have recovered roughly half of the losses, with future gains possible. FUELSNews has been on a break for the past week, so let’s catch up on the 4 biggest trends from last week and how they played into last week’s major price moves.

Omicron Variant

A new COVID-19 variant discovered in South Aftrica was escalated to “Variant of Concern” amid rapidly rising case rates. The variant seems to be more transmissible than past versions of the virus, and it contains an alarming number of mutations in the spike protein – the portion of the virus that virtually all vaccines target. The concern is that mutations will make the virus evade vaccines, undoing the public health progress made since the vaccine was released a year ago.

Oil markets reacted specifically to quick travel bans imposed on South African travel. Countries around the world banned travel to the area to prevent increased spread, though the new variant has been identified on several continents already. Although travel to South Africa isn’t a particularly important driver of global demand, traders saw how swiftly the globe could come to a halt if further outbreaks are reported.

The news about Omicron isn’t universally bad – some reports suggest the strain may cause less severe infections than variants such as Delta, the dominant strain worldwide. And experience with previous strains should provide a playbook for fighting this new version; global health organizations and vaccine companies have already announced research plans for a new Omicron booster.

It must be noted that Black Friday is well known to be a light trading day – with many US traders on vacation, a few big trades can cause significant market moves. Had the variant news been reported on another day, it’s possible the market move would have been much smaller.

Strategic Petroleum Reserve Release

You probably heard about the Strategic Petroleum Reserve release last week, with political pundits debating its value and impact. President Biden announced the US would release 50 million barrels from its strategic reserve, coordinated with several other countries including Japan, India, and China. The announced release will be the largest independent international release in history; other releases have been coordinated by the International Energy Agency in response to acute challenges.

Although the release is historic, it wasn’t enough to make a dent given the current global shortage. Goldman Sachs equated it to a “drop in the ocean”, saying the release wasn’t even as big as what the market had already priced in. Before the announcement, speculation about the release did cause crude prices to fall from $81 down to $76; after the announcement, prices rose slightly to $78. The move shows how serious the Biden administration is about reducing fuel prices, but also shows just how limited their arsenal is in impacting market dynamics.

Inventory News

Against a backdrop of many bigger headlines, the EIA released their inventory report last week, showing a small 1 million barrel build for crude inventories. Both gasoline and diesel stocks fell, however, bringing them even lower compared to seasonal averages. Fuel markets have been tight this year, especially given refinery turnarounds that were delayed in 2020 for financial reasons. Refiners do seem to be returning to normal production, though, so hopefully smoother sailing is ahead for fuel supplies.

Transmountain Pipeline Outage

In the Pacific Northwest, last week began with a bit of extra concern. The Transmountain Pipeline, which ships crude oil from Canada down to Washington and Orgeon refineries, was temporary offline due to flooding. On Friday, the company noted plans to restart this week at reduced capacity. In the mean time, refineries were forced to rely on barge and rail shipments to keep up with fuel demand during one of the heaviest travel weeks of the year. Normalized supply conditions are not expected until December or later, so elevated regional fuel prices could remain for the next few weeks. Regional prices rose roughly 18 cents relative to the NYMEX, while regional gasoline prices are up by a dime.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.