Europe Lockdowns, More Supply Cause 10-Cent Price Drop

FUELSNews will return on November 29 after the holiday week. From all of us at Mansfield, we wish you and yours a healthy and happy Thanksgiving!

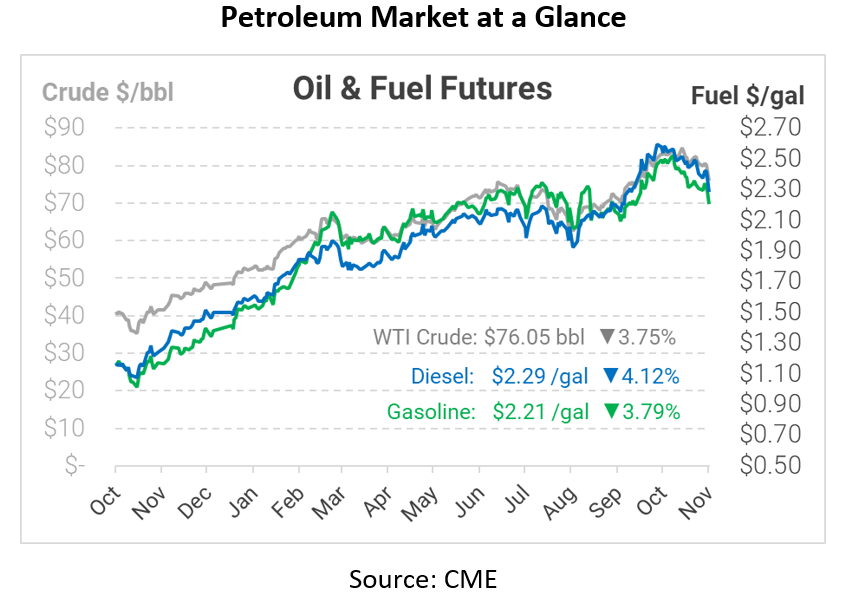

Fuel prices are tanking this morning, as both supply and demand seem to be moving in bearish directions. Despite this week’s inventory report showing tight supply, the near-term outlook is improving. Fuel prices are down 8-9 cents per gallon, while crude is down more than $2.50 from yesterday’s close. For fuel buyers maintaining a higher long-term price outlook, today’s plunge could present a good opportunity for locking in fuel prices.

This morning’s selloff follows restrictions in Europe to curb rising COVID cases. Austria became the first country to reimplement lockdown measures, closing non-essential shops and restricting people to their homes except for work. Germany said it may follow suit if trends do not improve. Many other European countries continue requiring vaccine passes or negative tests to access public restaurants and bars. Last year, lockdowns sent oil prices briefly into negative territory, and fuel traded below $1/gal. No one wants a return of severe restrictions, so we’ll see how governments act – and how governments react.

Adding to bearish pressure, large countries including the US and China seem to be getting serious about tackling the supply problems that have pushed prices so high. Yesterday, China announced their openness to releasing oil from strategic reserves to moderate oil prices. Despite the significant price drop this week, Goldman Sachs published a note that such releases would only have a temporary affect, are already priced into the market, and would not provide a long-term fix for supply issues.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.