Moe Signs of Relief – OPEC+ Sees Oversupply Ahead

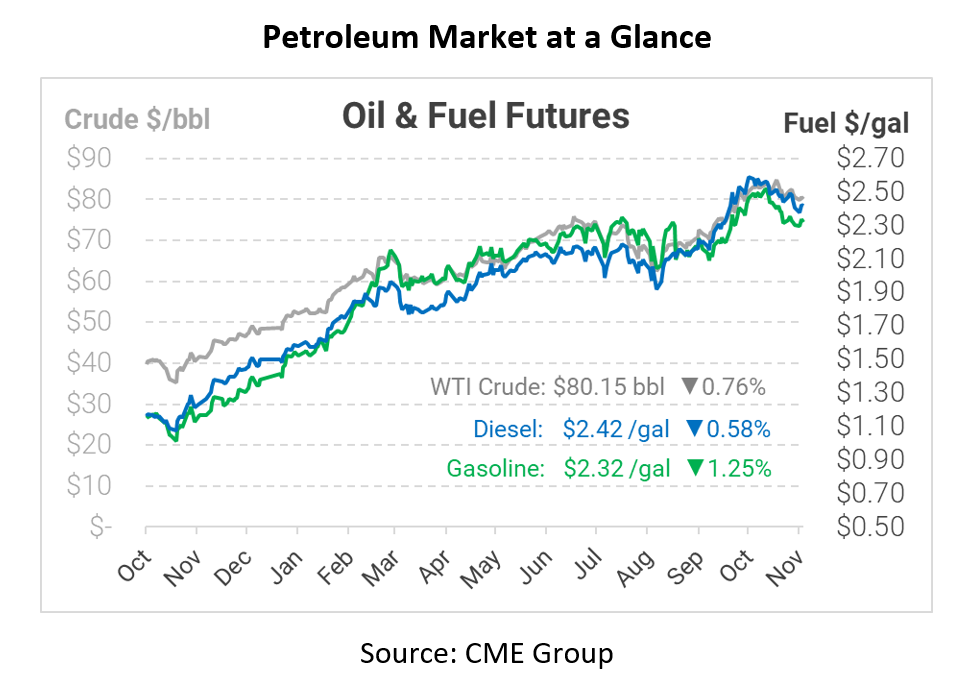

After picking up a bit of steam yesterday, oil prices are settling lower once again this morning. With the exception of Nov 4, when prices sank to $78/bbl, prices have been trading steadily in the $80-$85 range for over a month – a pattern that would have been unbelievable at the beginning of the year. Prices are in a holding pattern, and will likely remain their absent big changes in fundamental market forces.

What could break markets out of their current pattern? For starters, OPEC is now warning of a possible oversupply situation in the near future. The group sees oversupply beginning in December, meaning prices could begin edging lower. OPEC+ has been slowly increasing supplies each month, and the compounded affect is beginning to take hold. Moreover, US shale producers are slowly edging their way back to higher production, accounting for a larger portion of 2022 growth. The group expects demand to slow as well. So far, most countries are pushing to continue slow increases, rather than tapping the brakes, so relief may be coming soon.

How will we know when market conditions are improving? Well, we can obviously check the price at the pump when we fill up. But before that, keep an eye on weekly inventory data. Yesterday, the API reported a small crude inventory build of 0.7 million barrels, roughly half of what the market expected. They also showed gasoline stocks falling significantly, though diesel markets were surprisingly unchanged. The EIA showed across-the-board draws, suggesting tighter markets.

Right now, crude stocks are exactly in-line with the pre-COVID five-year average, suggesting balanced but not overly tight conditions. On the other hand, diesel and gasoline inventories are both roughly 6 million barrels below seasonal averages, keeping prices elevated. Crude stocks should move in line with global trends, while fuel markets will be more responsive to local demand and domestic refining activity. So whether you’re monitoring global prices or local trends, inventory data will be a good statistic to watch.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.