Week in Review – November 5, 2021

Bank of America has raised their forecast again, saying Brent crude could hit $120 bu the end of June. This exceeds the majority of other major bank forecasts. Goldman Sachs recently updated their forecast as well, noting upside risk to their $90/bbl oil forecast. Goldman reported that up to 1 million barrels per day of oil could be consumed for power this winter, nearly double earlier forecasts. With OPEC+ only adding 400 thousand barrels per day each month, and global demand continuing to rush toward 100 MMbpd, forecasters are expecting tight conditions in the near future.

Traders saw significant activity midweek due to the EIA’s inventory report, which showed crude inventories up by more than 4 MMbbls even as fuel stocks fell. Refiners are going through seasonal maintenance, meaning they’re consuming less crude oil but also pumping out less fuel. This is a normal seasonal dynamic, but some regions – such as Ohio and West Virginia – have seen unusually tight supply conditions as a result.

A pipeline reversal from the Midwest is also nearing completion, which could have lasting effects for Canadian oil producers. Marathon Pipelines LLC is in the final stages of reversing its Capline pipeline, which runs from the Gulf Coast up to the Chicago, IL region. This pipeline flow will be a major change in North America oil supply, as Capline has been the largest flowing south-to-north pipeline in the United States, providing almost 1.2 million barrels per day (bpd) to the market. The pipeline is expected to start shipping light volumes of oil this year, with the goal to be fully operations by the start of 2022.

Lastly, major headlines later the week surrounded the anticipated OPEC+ meeting scheduled for yesterday. The meeting focused on their production increase stance. Many analysts suggest that even though countries like the United States have asked OPEC+ for more supply output, the oil cartel will most likely maintain their original increase of 400,000 barrels per day (bpd). The reason analysts believe production output will remain the same stems from the simple stance OPEC+ is taking; they are worried about the implications of new COVID cases and their effect on the market. With OPEC+ staying put, and major oil companies thinking of alternative options to help curb the price of oil, there is sure to be a shake-up in the oil industry in the coming weeks.

Prices in Review

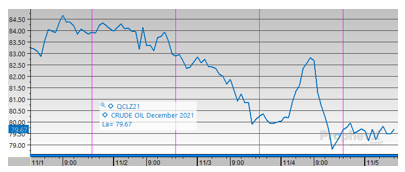

WTI Crude opened the week at $83.36. Prices rose steadily early in the week, before falling back. Crude opened Friday at $79.37, a decrease of $3.99 from Monday.

Diesel opened the week at $2.4764. Similar to crude, diesel slightly this week before drawing back. It opened Friday at $2.4153, a decrease of $0.0611 from Monday.

Gasoline opened the week at $2.3653. Prices rose earlier on Monday and Tuesday, with a major drop off happening Wednesday. Gasoline opened Friday at $2.3080, down $0.0573 from Monday’s opening price.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.