Week in Review – October 1, 2021

This week saw major headlines for oil markets as crude hit a near three-year high on Monday, DEF prices exploded, and inventory reports showed rising crude stocks.

Oil prices have risen over the past few weeks in the wake of two storms causing an estimated $40 billion in damages. On Monday, a peak of trading near a three-year high reinforced Goldman Sachs’ new forecast in which they project oil to exceed $90 per barrel in the later parts of the year. Goldman believes that the reason for this $90/barrel forecast is due to the “lingering impact of Hurricane Ida on supply while demand ramps up, particularly in COVID-averse Asia.”

DEF prices have been rocketing higher over the past month, on the heels of a steady upward trajectory throughout 2021. The steep increase is due to rising urea prices. Urea, created from ammonia, has important uses in fertilizer in addition to being the main ingredient in DEF. With a few exceptions, prices generally trend in the $200-$300 range per ton, but in June prices blew past $400/ton, and since then have continued climbing to a staggering $600/ton. Click Here to find out the three reasons why DEF prices have risen so quickly.

Lastly, we reported yesterday that during the week of September 24, United States oil inventory levels rose by 4.6 million barrels. This rise was associated with increased production output in the Gulf following Hurricane Ida outages. The total inventory level ended last week at 418.5 million barrels, according to the Energy Information Administration (EIA). In addition to rising inventories, the US Dollar reached a one-year high, creating headwinds for oil prices this week.

Prices in Review

WTI Crude opened the week at $74.19. Prices were extremely volatile this week, with many changes day-to-day. Crude opened Friday at $75.12, an increase of $0.93 from Monday.

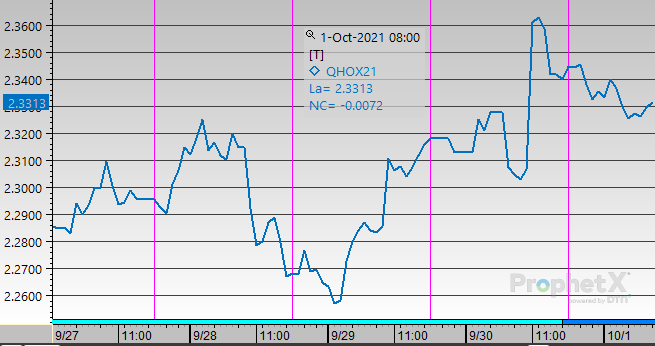

Diesel opened the week at $2.2693. Similar to crude, diesel was extremely volatile this week. It opened Friday at $2.3396, an increase of $0.0703 from Monday.

Gasoline opened the week at $2.1874. Prices followed the volatile trends of crude and diesel this week. Gasoline opened Friday at $2.1909, a decrease of $0.0035.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.