Natural Gas News – September 30, 2021

Natural Gas News – September 30, 2021

NYMEX Henry Hub gas nears $6 on supply concerns, lingering Ida impact

The NYMEX Henry Hub prompt-month natural gas contract continued a four-day rally Sept. 28, nearing heights last seen in February 2014, as a slow restart to Gulf of Mexico gas production following Hurricane Ida compounds supply tightness in global gas markets. Receive daily email alerts, subscriber notes & personalize your experience. Register Now NYMEX October tested the waters beyond $6/MMBtu on its last day of trading prior to expiration, with intraday highs reaching $6.28/MMBtu. Ultimately, the contract settled at $5.841/MMBtu, up 13.50 cents from the prior day’s settlement, according to preliminary CME Group settlement data. The futures price rally also extended into the physical Southeast gas market. The Henry Hub cash price soared to $5.93/MMBtu while demand hub Transcontinental Gas Pipe Line Zone 4 rose to … For more info go to https://bit.ly/3zWgLRB

Why Natural Gas Prices Are Rising This Year

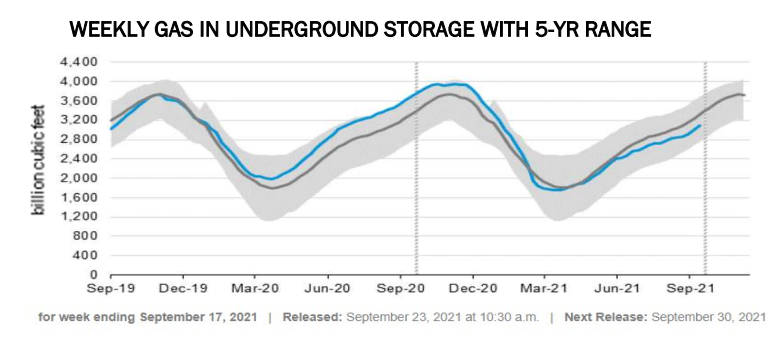

According to the recent EIA Natural Gas Storage Report, U.S. natural gas inventories are down by 6.9% compared to the 5-year average. The situation is even more tense in some European countries. According to Celsius Energy, Germany’s natural gas inventories are down by as much as 26% from the 5-year average. Know where Natural Gas is headed? Trading Derivatives carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Derivatives may not be suitable for all investors, so please ensure that you fully understand the risks involved, and seek independent advice if necessary. A Product Disclosure Statement (PDS) can be obtained either from this website or on request from our offices and should be considered before entering into a transacti… For more info go to https://bit.ly/3AVwguA

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.