Crude Trades at Near Three-Year High

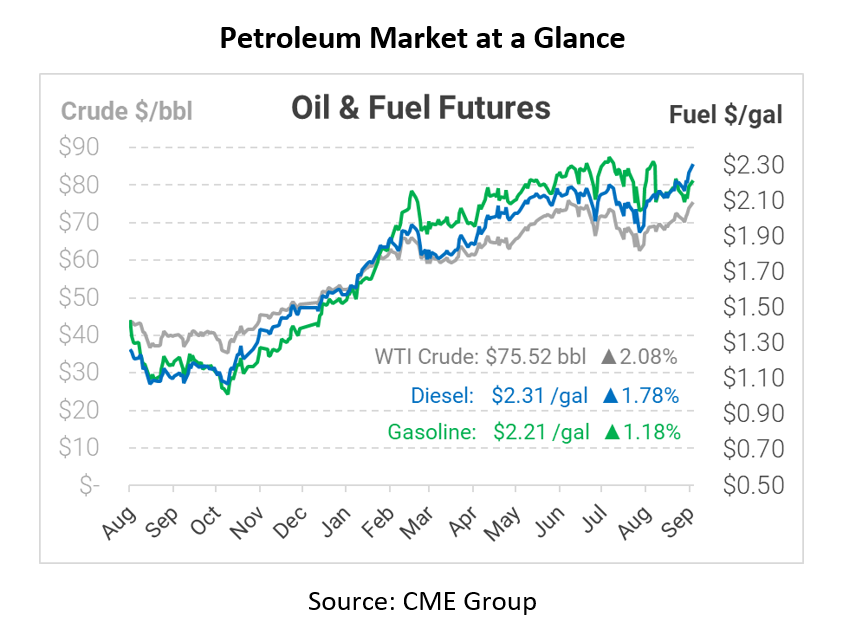

This morning crude was trading at a near three-year high as prices continued to rally following the hurricanes in the Gulf of Mexico that disrupted fuel supply this month. Today crude opened up at $74.19, trading as high as $75.56. Diesel opened the morning at $2.2693, and gasoline opened at $2.1874.

In the wake of two disruptive storms that have been estimated to have caused over $40 billion in damages, oil prices have risen over the past few weeks. Today’s peak of trading near a three-year high reinforces Goldman Sachs’ new forecast in which they project oil to exceed $90 per barrel in the later parts of the year. Goldman believes that the reason for this $90/barrel forecast is due to the “lingering impact of Hurricane Ida on supply while demand ramps up, particularly in COVID-averse Asia.” With this hurricane effect in mind, analysts also suggest that Ida could prove to be the most bullish storm in United States hurricane history.

On a positive note, oil demand continues to ramp up, hitting comparable pre-pandemic levels. This primarily reflects the decrease in COVID cases around the country over the past month to a point where people are beginning to travel more than they used to. Unfortunately, while the United States is seeing declining numbers, areas in Asia such as Singapore are dealing with a deadly amount of cases that have begun to shut down their country. While COVID cases continue to fluctuate and supply and demand are continually disrupted by the evolving market post-hurricane season, higher oil prices are the expectation for the rest of this year.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.