3 Reasons Fuel is Rising This Morning

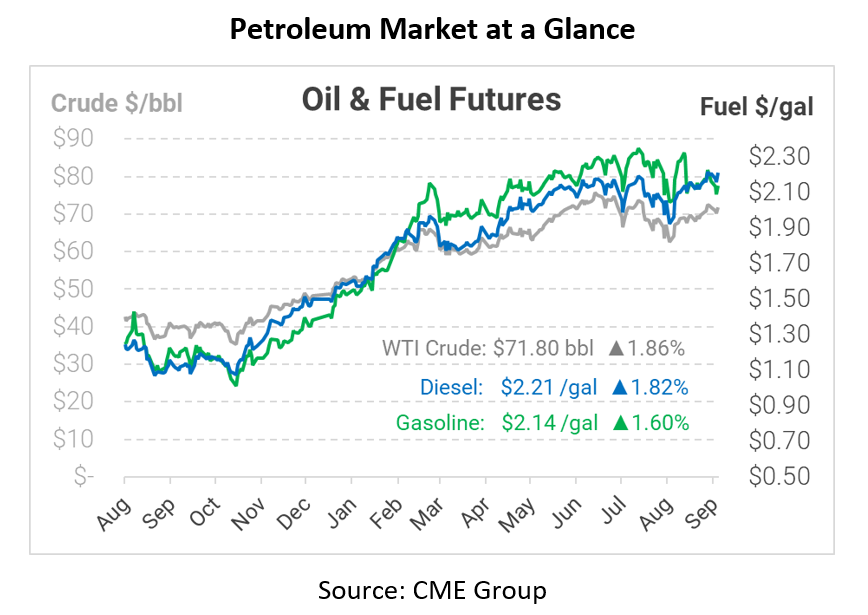

Financial markets are getting a boost this morning thanks to a capital injection of roughly $18.6 billion from China’s central bank. We reported yesterday that Evergrande, the Chinese real estate giant, is having trouble making their debt payments; for now, it appears they’ll be able to continue operating. As investors breathe a big sigh of relief, prices are taking flight. Oil is up more than $1/bbl, and fuel prices are gaining roughly 3 cents.

Providing further market support, OPEC+ reportedly produced even less than their production quotas allow, achieving 116% compliance with their production cuts. The oil cartel agreed to increase output each month until the end of 2021, but it seems that a year and a half of limited supply has left them ill-prepared to hike output so quickly. The outage stems largely from production outages in Nigeria and Angola, though Russia (a member of OPEC+) also had an unexplained drop in their oil flows. With demand remaining strong, continued OPEC+ restraint has weighed on markets and kept prices elevated.

Finally, the API reported bullish data yesterday, providing tailwinds to rising fuel prices. This week, the organization is calling for a 6 million barrel draw, more than double the expected draw. They also reported a strong 2.7 million barrel draw for diesel stocks and a meager gasoline dip as well. With all the storm activity, traders have been following inventory movements closely to see how America’s fundamental supply position has changed – and how that positions inventories heading into the winter.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.