Fuel Up 5 Cents on Weak Supply, Robust Demand

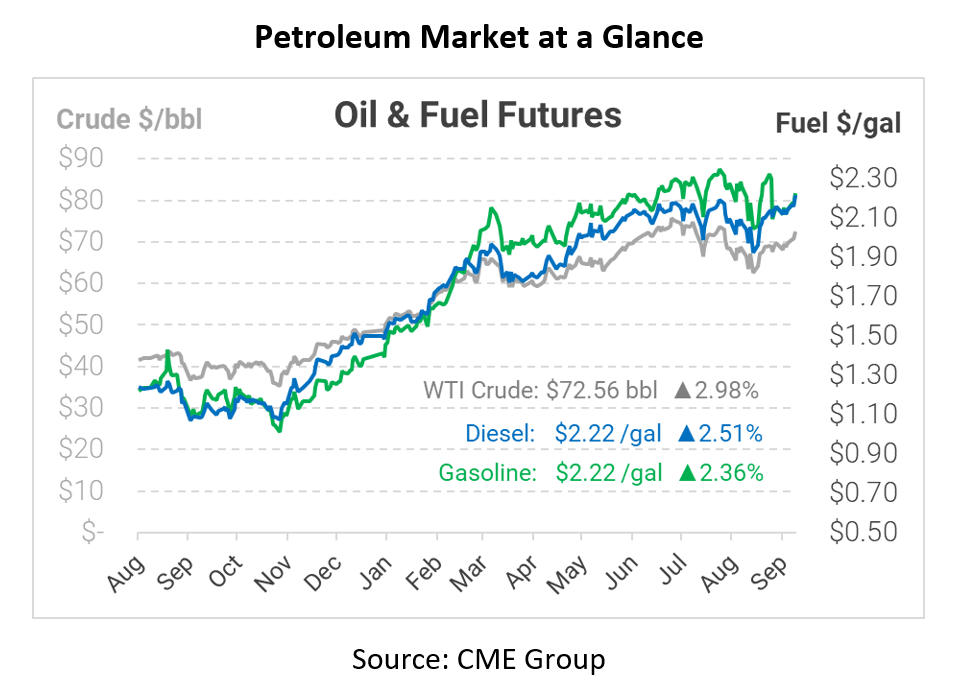

Each month, three major groups – OPEC, the US’s Energy Information Administration (EIA), and the International Energy Agency (IEA) – publish reports including their outlook on global markets. Typically, the market absorbs those reports with a shrug, but this month they’re having a bigger impact on prices. OPEC’s Monthly Oil Market Report increased its forecast for 2022 oil demand, bringing the stat back above 100 million barrels per day for the first time since 2019. The IEA’s September Oil Market Report looked back at recent trends, noting that Hurricane Ida reduced oil supplies at a rate that more than offset OPEC+’s monthly increase. Between strengthening demand and reduced supplies, oil markets are getting a big lift this morning.

Adding to the bullish sentiment, the API’s weekly inventory data showed steep across-the-board cuts, exceeding market expectations. With fuel inventories already hovering at or below pre-COVID seasonal averages, markets are concerned about the continued downward trend. Of course, last week was both a holiday weekend and suffered from continued Gulf Coast refinery outages, so the draws are no surprise. The EIA will publish their detailed data at 10:30 am this morning, and the consensus is that the agency will show solid draws across crude, diesel, and gasoline.

Although most of the news is pointing to higher prices, the news isn’t all bad for consumers today. The Colonial Pipeline, which supplies most of the East Coast’s fuel supply, is resuming partial operations despite power outages in Texas. The pipeline closed yesterday morning as a precaution, to ensure the integrity of the line. Colonial reported that it has been able to receive fuel from refineries in and around Houston, so the line can continue sending product northeast.

In other good news, today is September 15 – the day when gasoline suppliers can officially cut over from expensive summer-spec gasoline to cheaper winter-spec gasoline. Last week, we explained why high gasoline prices are coming to an end, so check out that article for more details on the change. Consumers should see prices fall at the pump, and bulk gasoline buyers should see reduced costs.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.