3 Signs Another Fuel Price Rally Could Be Coming

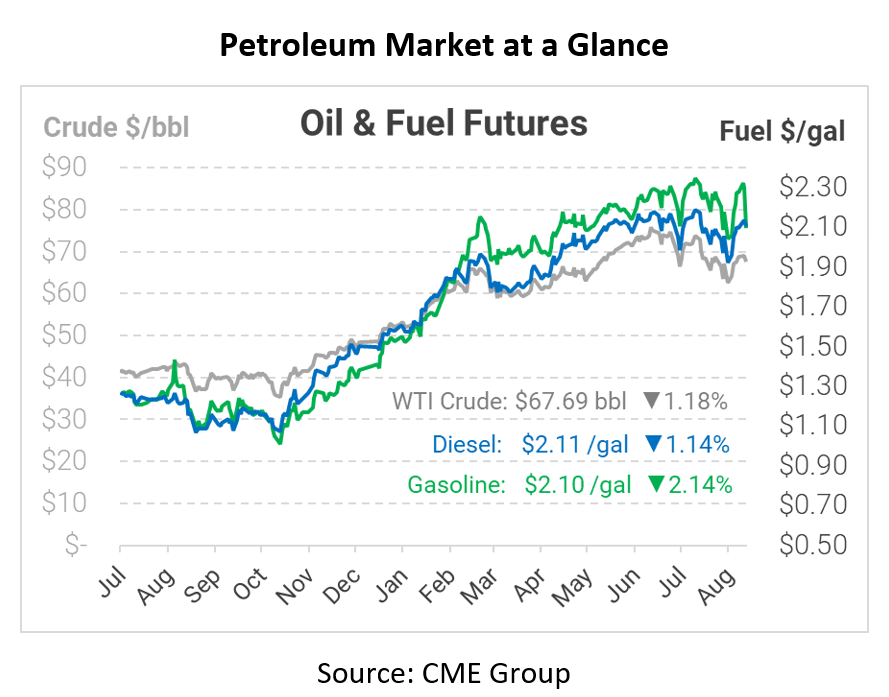

Fuel prices tumbled this morning despite several supportive headlines over the past day, but the EIA’s supportive data has helped curb some of the losses. OPEC+ is planning to stick with their cuts, the API and EIA reported a strong crude inventory draw, and oil contract sales are beginning to slow. We’ll unpack each of these headlines today, and show how these three factors may just suggest a fuel price rally is around the corner.

Yesterday, OPEC+ met to discuss 2022 oil forecasts, projecting even tighter markets than before. Globally, crude inventory levels are below their 2015-2019 average level. OPEC had originally expected stocks to rise to the average by January 2022, but now that won’t occur until later in 2022. Despite the bullish forecast, OPEC stuck to their current strategy of slowly increasing supplies by 400 kbpd. If OPEC’s report is correct, oil will remain tight for the next several months, pushing prices higher.

Inventory news has also been indicative of higher prices, though with some exceptions. Yesterday, the API reported a steep draw for crude oil, a mild diesel draw, and a surprise gasoline build. The EIA confirmed the inventory directions in their 10:30 am report this morning, though their crude draw estimation was more than double the market’s expected level. Oil stocks have been generally trending lower, providing support to the market. Next week’s report will be a bit of an anomaly due to Hurricane Ida, so don’t be surprised by a steep build next week.

Finally, oil trading data reported by the CFTC suggest hedge funds may be slowing their oil contract sales. According to Reuters’ John Kemp, hedge funds have sold some 268 million barrels of oil over the past 10 weeks, unwinding their long oil bets to capture profits after a long bull run. Sales have been slower over the last few weeks, though, suggesting that a major headwind for oil prices may be ending soon. With aggressive hedge fund selling, oil bulls may have more clout – meaning higher prices in the future.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.