Ida Knocks Out Major Refineries, Disrupts Oil Production

Hurricane Ida has left its mark on the southeast after making landfall Sunday. When the category four hurricane hit Louisiana, fuel markets were sure to be disrupted as it crushed through towns with winds of 150 mph. On Sunday, New Orleans was left without power as the storm passed through, creating problems for refineries in the Gulf.

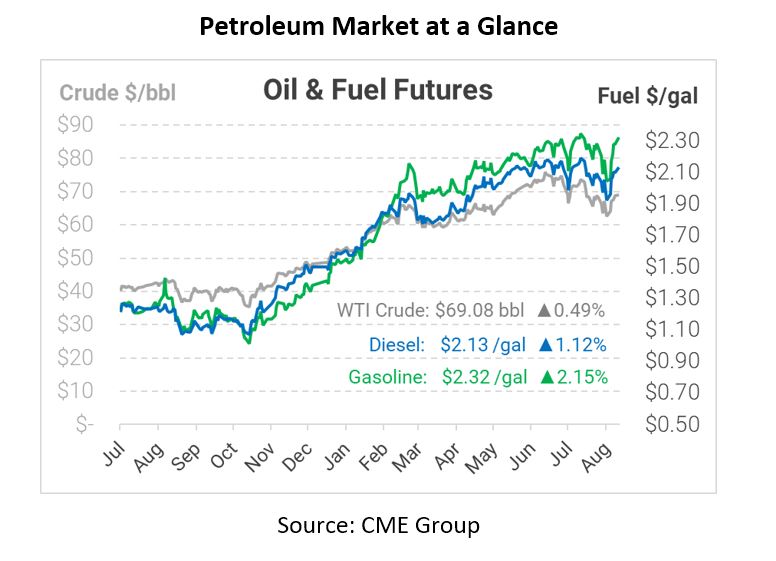

Right now, there are at least six Gulf Coast refineries that have stopped operations due to the impact of the hurricane. According to GasBuddy, retail gasoline prices will go up about 5 to 10 cents as a direct result. Along with refineries shut down, the Colonial Pipeline halted deliveries and is unsure when operations will resume fully. These shutdowns are already directly affecting supply while driving panic-buying among consumers fearful of an outage. Upwards of 1.74 million barrels of oil output were lost because of shut-ins from the storm, and unfortunately, gasoline prices are likely to rise in the southeast if the damage sustained from the hurricane shows to be extreme. This, alongside the already high prices, will be a hit for consumers, especially as Labor Day nears.

In other news, OPEC+ is still scheduled to meet on Wednesday to discuss an increase in oil output. According to analysts, the expected increase of 400,000 bpd to the global market will likely pass, although there has been some pushback from Kuwait on this number. Markets are watching OPEC+ closely, given increased travel restrictions in some areas of the country. Some believe that adding supply at this point could cause prices to drop sharply, while others point out that demand remains strong enough to absorb the added supply despite rising COVID cases.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.