Will Today’s Inventory Reports Extend the Oil Rally?

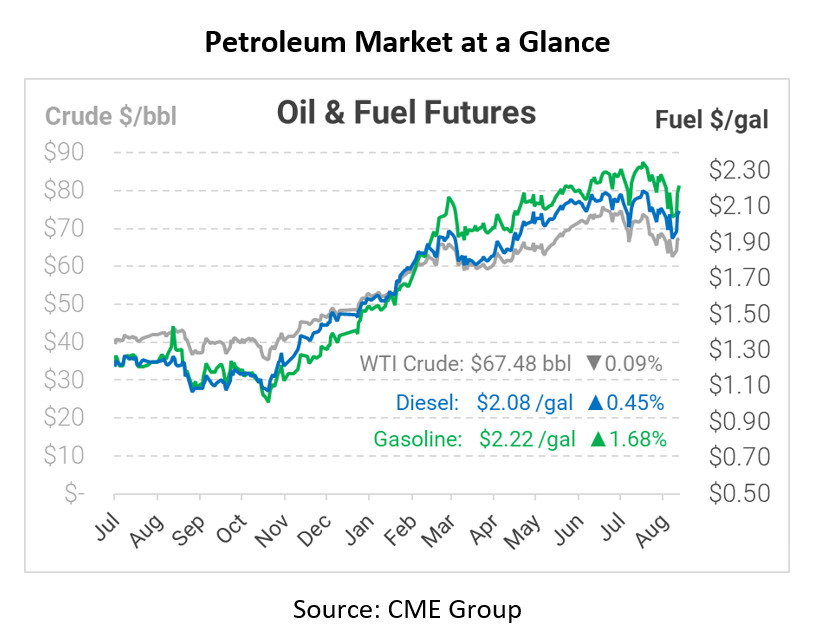

After crude oil gained $2/bbl yesterday, prices are trading flat this morning as the market awaits updated inventory data from the EIA. Gasoline prices are taking the lead today, posting another 3.5 cent gain given positive inventory trends and continued optimism related to the FDA’s approval of Pfizer’s vaccine.

The API’s inventory numbers were unenthusiastic, showing small draws across the petroleum market. The data largely matched market expectations, though the reported crude draw was half of what analysts had forecast. Focus turns to the EIA’s more definitive weekly data, which will be published at 10:30 am this morning. If the report confirms market expectations, then oil prices could creep even higher, pushing the rally farther.

In renewable energy news, Imperial Oil is planning to begin producing renewable diesel at its Stratchcona refinery in Alberta. Its parent company, ExxonMobil, has committed to producing 40 kbpd of renewable diesel by the end of 2025. The Imperial RD output will take advantage of Canada’s Clean Fuel Standard, set to take effect next year. Canada’s CFS program is set to gradually reduce carbon emissions over time, cutting annual emissions by 20 megatons, according to a Reuters report. As the program ramps up, expect to see more alternative fuel projects announced among Canadian energy producers.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.