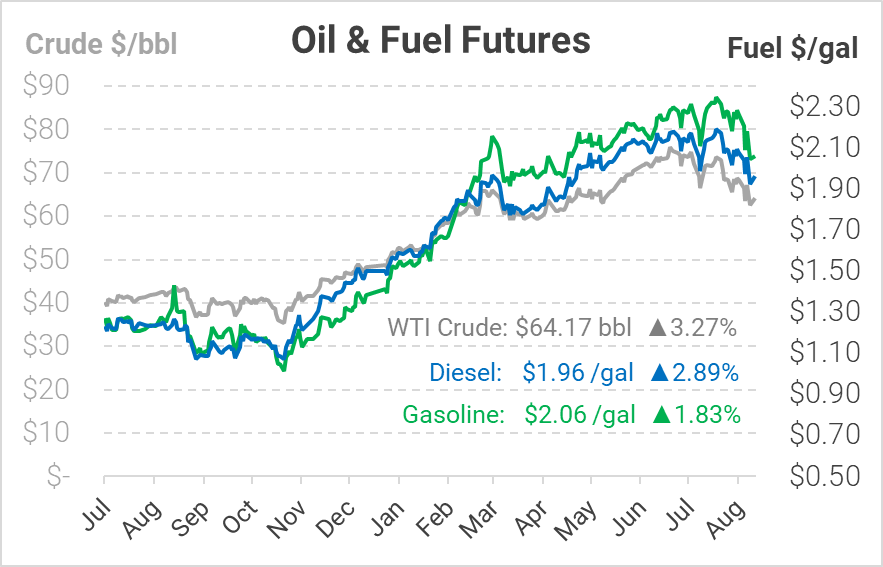

Oil Rockets Higher After 3-Month Low

This morning crude opened at $61.96, the lowest price since May; however, prices began rebounding later in the morning on a weaker US dollar and short-covering. Similar to crude oil this morning, diesel also opened at a multi-month low of $1.8970 and gasoline opened at $2.0101 to start off the week.

The US Dollar has been on a hot streak, reaching a nine-month high as global uncertainty sends investors racing to the dollar’s safety. After a long run higher, the USD is ticking down today, relieving some pressure on oil markets. The dollar’s rise has been attributed to the Fed hinting that it could reduce its bond-buying program, which would inject fewer dollars into the economy – functionally reducing the supply of dollars. This policy would cause other currencies to weaken versus the USD, meaning that foreign traders would have to spend more in their local currencies to trade oil. Oil prices reflected this over the past few weeks, falling from $75/bbl to just $62/bbl. Today, the USD retreated from its highs, providing some relief to battered oil markets and allowing prices to rise. With the Fed meeting later this week to review bond-buying, expect the USD to continue weighing on oil markets.

Along with the weakening US dollar, China has introduced new restrictions to combat the effects of the Delta variant, affecting air travel, shipping, and supply chains globally. China, being the world’s second-largest oil importer and a major global trader, will have a large effect on prices going forward if current restrictions hold. Many in China have sought to curtail restrictions, given current low case rates and the severe economic toll. There’s still a global fight to control the pandemic, but if the fight against the Delta variant can be won then there is much hope.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.