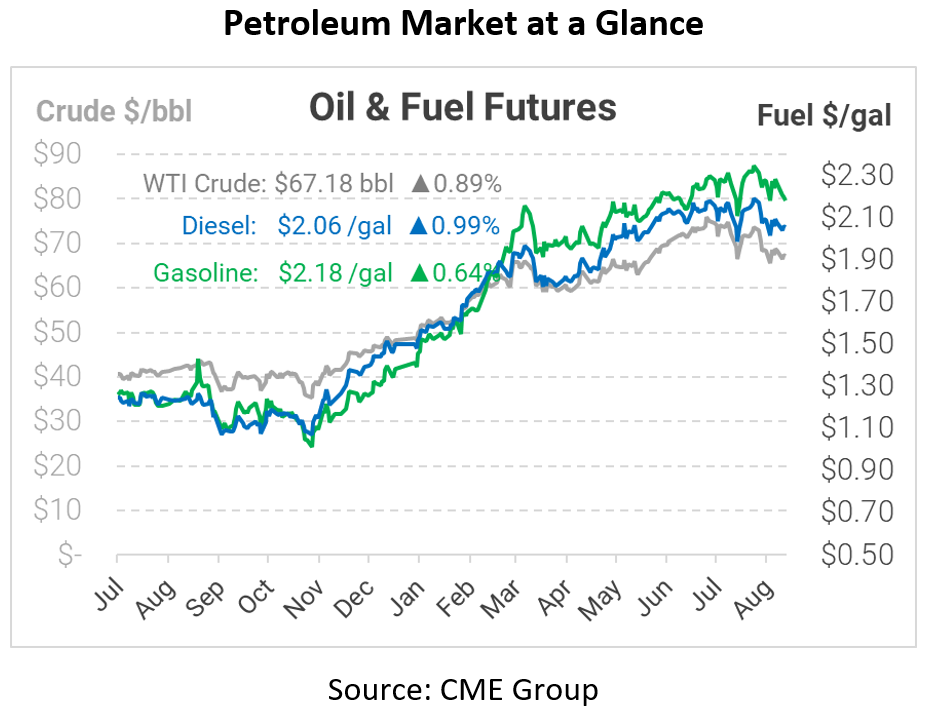

Prices Rise as Crude Inventories Fall

This morning oil prices rose as crude inventory levels in the U.S. fell once again. The EIA reported a 3.2 million barrel (MMbbl) draw, double the expected 3.2 MMbbl draw. Gasoline inventories were also expected to take a hit, but surprised with a 0.7 MMbbl gain. Diesel also surprised, but with a steep 2.7 MMbbl draw. Today crude opened at $66.58, the lowest in a 4-week period. Diesel opened low as well at $2.0741, and gasoline at $2.2465.

As Europe and India face problems not only with COVID but with demand, we can expect to see a more volatile oil market. Frequent pullbacks may be seen as countries try to curb the pandemic issues they are facing. Lockdowns restrict oil consumption, resulting in lower prices; however, traders experiencing stronger demand in other areas may choose to buy the dip and keep prices elevated. OPEC+ seems not to have heeded calls from the White House to amend their output approach.

In other news, the Fed’s meeting on July 27-28 will finally have its minutes released where they are expected to show that the Fed still has much faith in the economy to recover from the pandemic even as the Delta variant continues to slow down everyday life. Today’s 2 p.m. minute release will be much anticipated as the country is still curious to see what their position is during the ongoing inflation process accompanied with virus variants.

This article is part of Daily Market News & Insights

Tagged: eia, Europe, India, lockdowns, oil consumption

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.