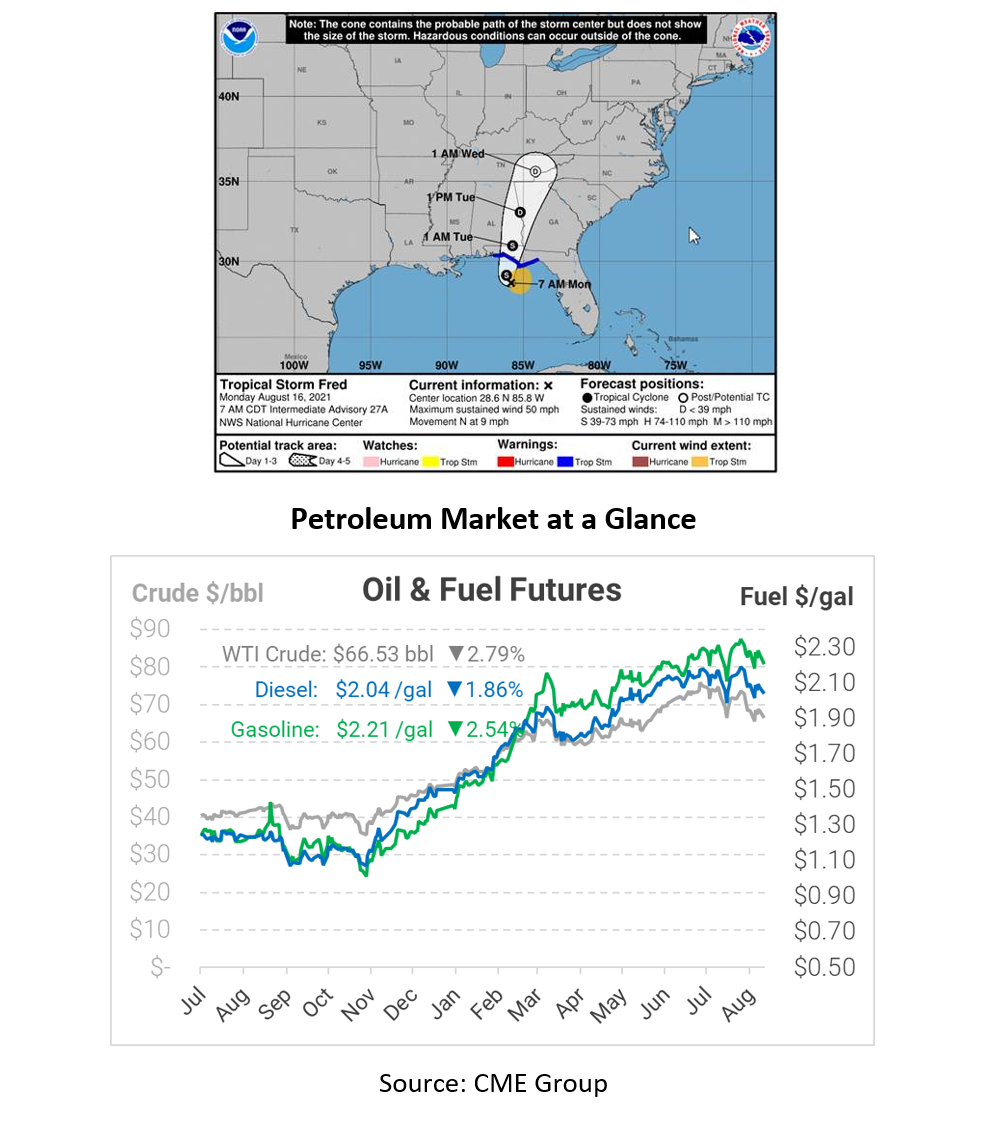

Oil Prices Continue to Fall as Chinese Economy Falters

Prices continue to fall this morning after refining activity in China over the weekend fell to its lowest output in 14 months, accompanied by an influx of new COVID-19 cases. Reports showed that output numbers in July 2021 have been lower than July 2020 for China. Today crude oil opened at $67.71, diesel opened at $2.0689, and gasoline at $2.2465.

Back in July, Chinese factory output slowied down, mainly due to new COVID-19 cases in the country. Many things have gone wrong for refiners in China, including the challenge of trying to meet tighter import quotas for a majority of the independent refiners. China imposes import quotas to protect their local crude producers. For global producers this poses many problems as China is the world’s largest oil importer.

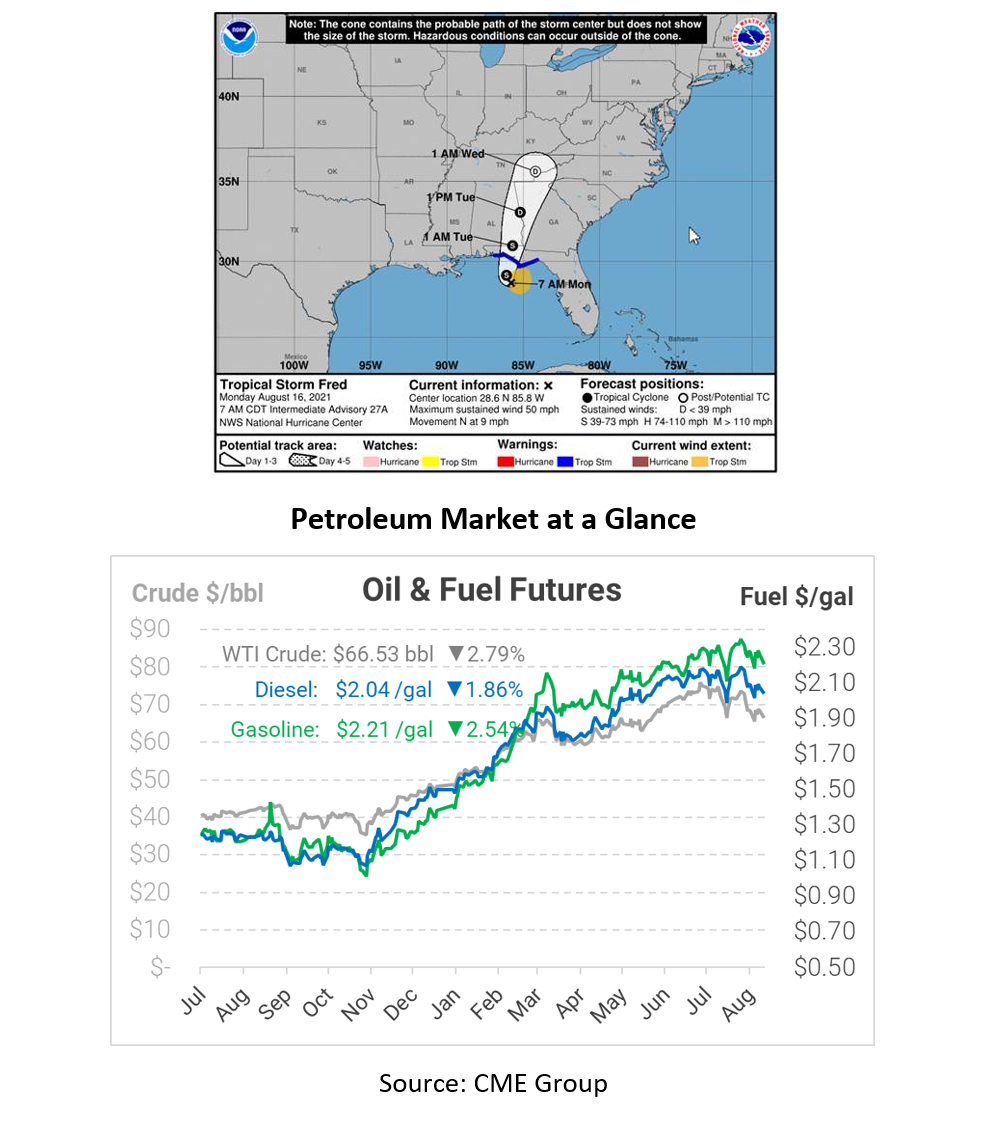

Looking at the 2021 Atlanta Hurricane Season, Tropical Storm Fred continues to strengthen as it moves toward the Florida Panhandle. The storm is expected to make landfall later today in Florida, bringing heavy rain, gusty winds, and storm surges. As the storm moves east, it is expected to weaken when it reaches parts of Alabama and western Georgia but will still bring storm-like effects with heavy rain and wind. Aside from Tropical Storm Fred, Tropical Depression Eight is currently being tracked over Bermuda and could possibly be upgraded to a tropical storm later today.

This article is part of COVID-19

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.