President Biden Calls on OPEC to Moderate Prices

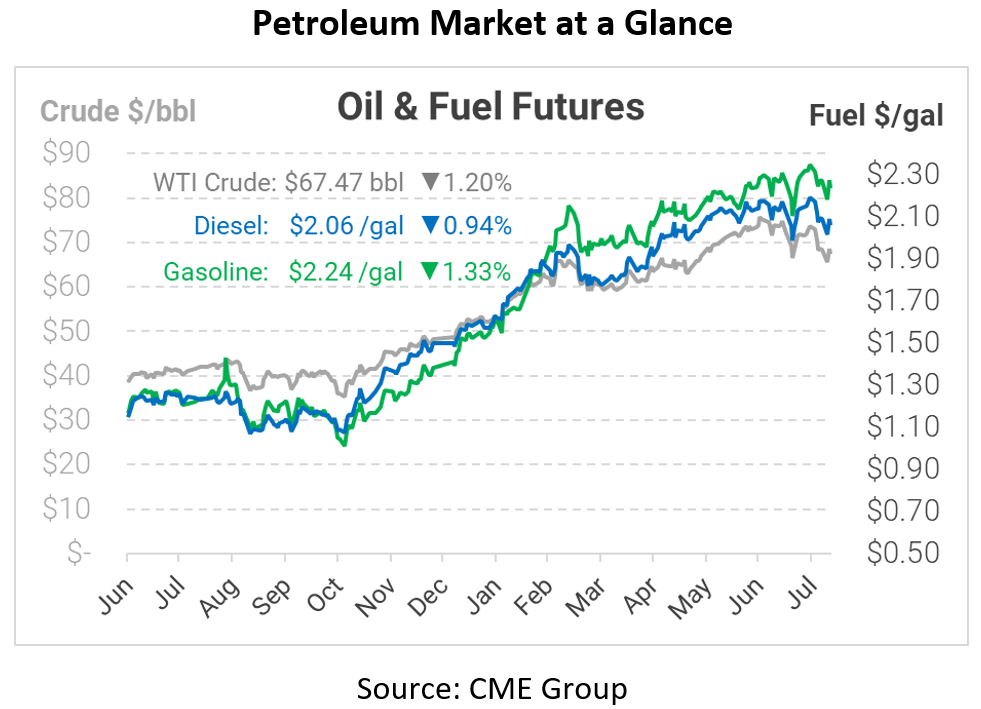

Fuel prices are retreating a bit this morning, offsetting yesterday’s 3-4 cent gains. The White House is calling on OPEC to loosen their quotas, with officials at different levels reaching out to OPEC colleagues. Biden administration officials noted that OPEC+’s 400-kbpd supply increase does not go far enough to balance the market. Previous calls (and tweets) from White House officials haven’t had much of an impact on the organization’s policies, so it’s unclear what the impact will be. Still, OPEC+ doesn’t want to be blamed for dampening economic growth, so they may heed the call.

Adding to the economic pressure, the US Labor Department reported that July Consumer Price Inflation was 5.4% from a year prior, in line with June levels. CPI measures a basket of common household items, showing the impact of inflation on regular family spending. Gasoline prices are an important component of consumer spending, so the hefty rise in oil prices has contributed to the high CPI statistics.

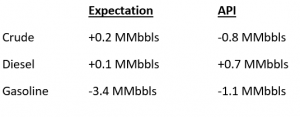

In inventory news, the API’s report last night was quite neutral, with crude and gasoline posting a small draw while diesel experienced a small build. Markets will be watching the EIA data later today for more clues on market direction. A steeper draw could give prices a boost, while product builds may cause markets to continue trending lower over the coming week.

This article is part of Daily Market News & Insights

Tagged: eia, Inflation, opec, White House

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.