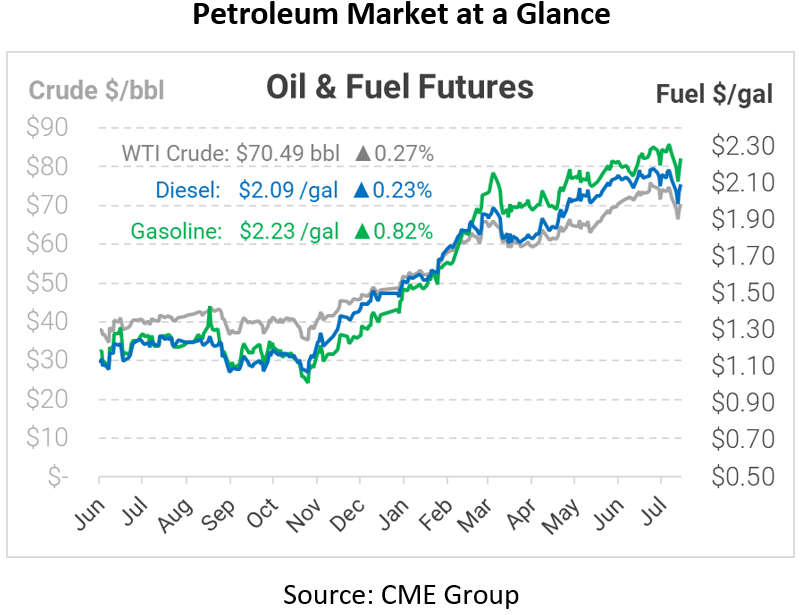

Prices Rise Over 4% As Inventory Levels Increase

Today, oil prices continue to rise over 4% despite an unexpected crude inventory hike. Investors are buying the dip, capitalizing on low prices in the hopes that prices will continue their march higher over the next few months.

Rising prices are somewhat counter-intuitive, given yesterday’s bearish inventory data. Crude oil inventory levels rose Wednesday for the first time since May. While analysts expected over a 4.5-million-barrel decrease, inventory levels rose by 2.1 million barrels. On the other hand, diesel and gasoline stocks moved lower. Despite normalized refinery activity, demand is outpacing fuel supplies, draining inventories.

Coronavirus variants could severely impact the market going forward. Australia and Asia are two examples of areas being hit hard right now from the virus variants, which have had a profound effect on their oil demand. If this were to happen to the majority of the world, it would be worrisome as countries are still trying to rebound their economies from the disastrous effects of COVID-19, to begin with.

Today, oil holds on to its biggest gain in over three months on the idea that still-recovering demand will again impact the market. This morning crude opened at $70.22, diesel at $2.0869, and gasoline at $2.2139. For now, people remain worried that the new virus variants will once again disrupt the supply chain. Still, time will tell as new vaccines and virus-fighting countermeasures are being put into place around the globe.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.