Saudis and UAE Agree on OPEC Production Deal

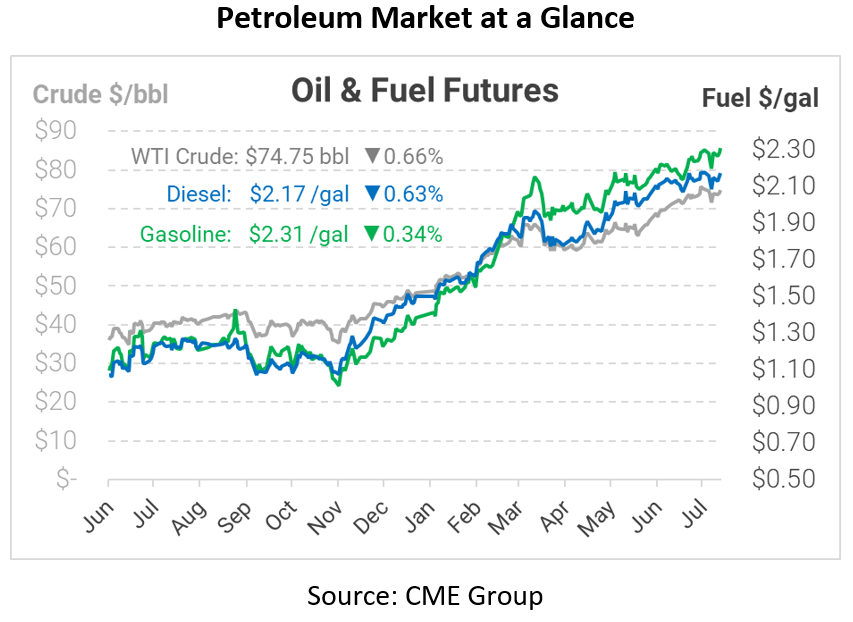

Oil prices are turning lower this morning, following news that OPEC may finally be near an agreement to increase production for the remainder of the year. Saudi Arabia and the UAE have been at odds for the past two weeks, derailing members’ consensus to increase output by 400 kbpd each month between now and December. The UAE agreed with the increase but noted that their capacity has risen, so they ought to be allowed to produce more. Saudi Arabia balked at the request, letting talks lapse and maintaining existing production cuts.

This morning, Saudi Arabia and the UAE reportedly reached an agreement that would enable the UAE to pump more after the original deal expires in April 2022, though not quite as much as the UAE’s original request. Now that both parties agree, OPEC+ can move forward with increasing output each month while also extending cuts from April 2022 until the end of next year. Markets are unsurprisingly trading a bit lower since the news means more production in the future. Still, it adds certainty to the market, dampening volatility. For consumers, the deal doesn’t go quite far enough to reduce the supply shortage in Q3, so expect prices to remain tight for the next few months.

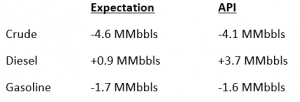

The EIA’s weekly data was delayed this morning, but markets are expecting another crude and gasoline draw, accompanied by a meager build in diesel stocks. Yesterday’s API report showed crude and gasoline stocks moving in line with expectations, while diesel’s build was larger. After last week’s huge gasoline demand increase, traders are watching closely to see how demand will shape up this week.

This article is part of Daily Market News & Insights

Tagged: eia, Oil production, opec, UAE

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.