Prices Slip as Delta Variant Cases Increase

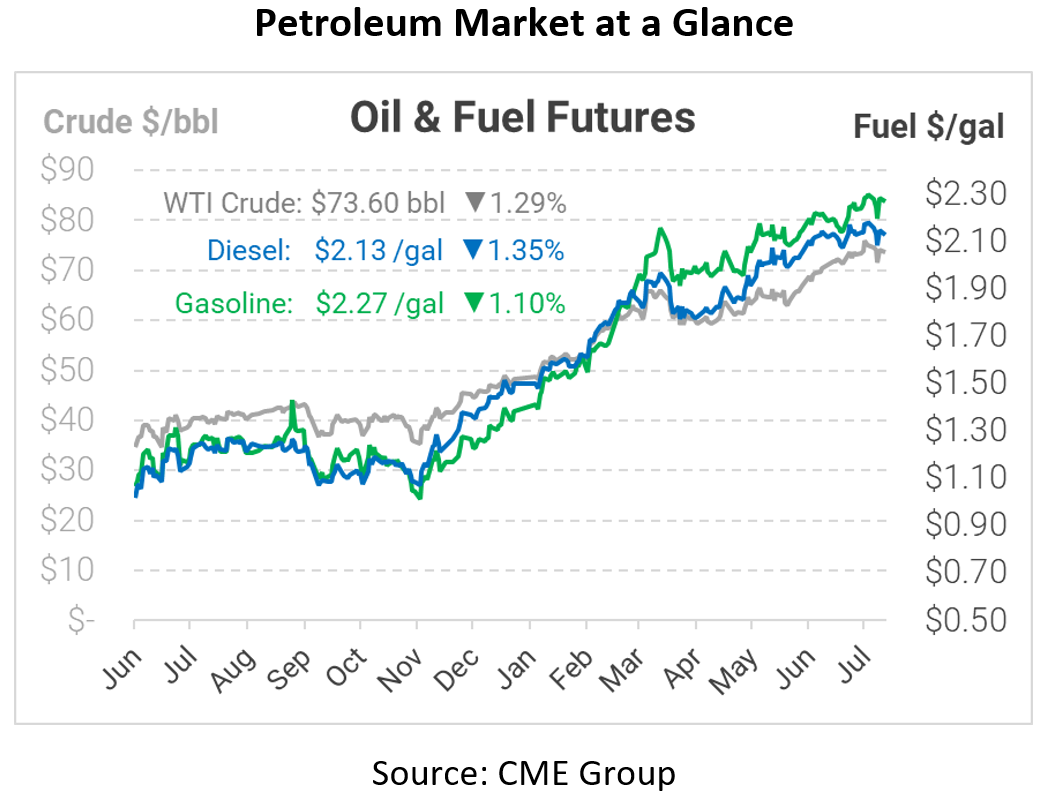

This morning prices fell as the world has seen a heavy increase in COVID-19 variant cases. These new strains, along with already tight supply and demand, have started to concern investors. Today crude opened at $74.74, diesel at $2.1527, and gasoline at $2.2869.

One of the biggest threats to the market right now is the lack of vaccines across the globe and the steady rise of new variant cases. The scare of new variants heavily weighs oil prices despite the tight supply and demand balance the world is seeing. According to the Center for Disease Control and Prevention (CDC), over 50% of all new COVID-19 cases have to do with variant forms of the virus. For those worried about the threat of new variants, medical professionals say the standard COVID-19 vaccines are still effective against some variants. However, they recommend getting a booster shot in the future. Since the rise of new variants and in an attempt to put some people at ease regarding COVID-19, the CDC has also released a new imaging map that shows the ‘Level of Community Transmission’ as seen below.

Adding to market apprehension, OPEC+ abandoned their talks last week regarding the future of production output. The meeting’s failure will make markets tighter in the short-term, but traders fear it could cause an all-out collapse of the OPEC+ deal, triggering a production glut in the future. In the meantime, US producers are very slowly reacting to higher prices by adding more oil and natural gas rigs for a second week straight.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.