Oil Continues to Fall with OPEC+ Variability

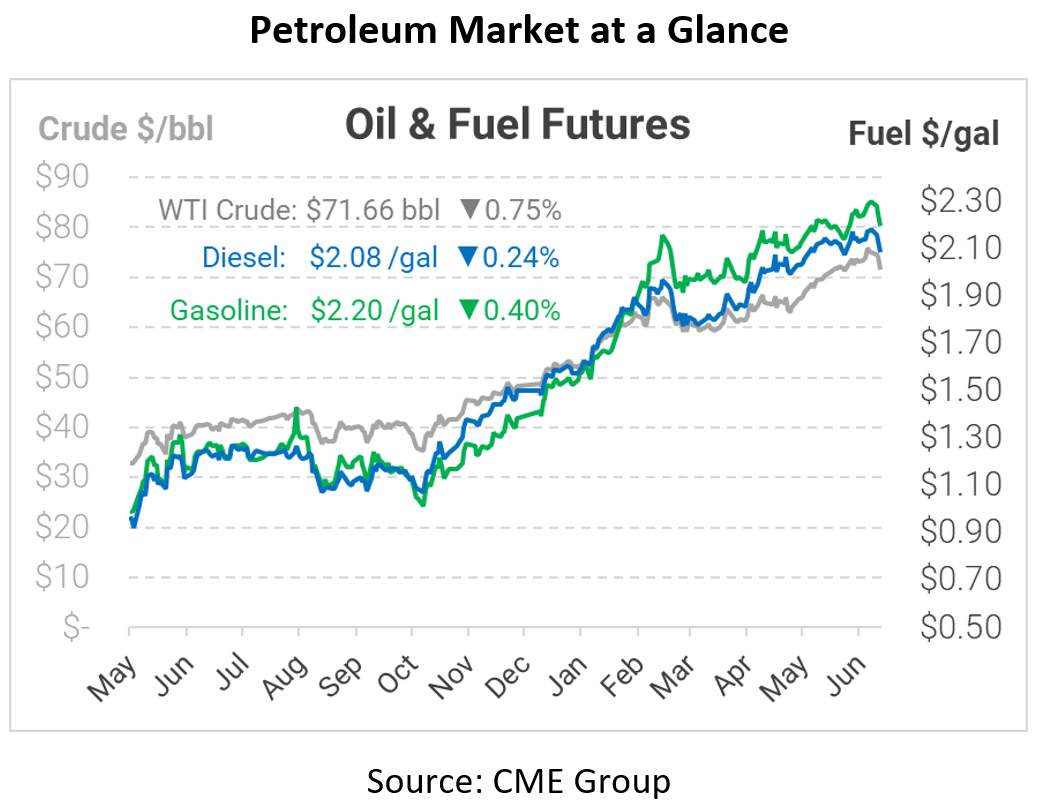

For a third day straight, oil prices have fallen since OPEC failed to reach a production increase agreement earlier this week. This morning crude opened at $72.17, diesel at $2.0849, and gasoline at $2.2049. Analysts suggest an agreement to raise production may be out of the question for the near-term, as Saudi Arabia and the UAE feud over the UAE’s production levels. It may seem surprising that oil prices are falling, since the vote was on whether to add MORE supply to the market.

The reasoning behind the drop in prices over the past few days comes from possible noncompliance from countries like the United Arab Emirates (UAE). With group unity unwinding, it’s possible that countries like the UAE, Russia, and others could abandon the agreement altogether and unleash their full supply capacity. Countries fighting for market share would bring a repeat of the scenario that unfolded just before the pandemic.

When the pandemic began, OPEC+ sent prices plummeting due to a disagreement between Saudi Arabia and Russia on market share. Both countries announced plans to pump millions of additional barrels of oil each day to grab market share from each other and obliterate US shale. It’s been more than a year since the group put aside their differences and signed historic cuts, but now infighting is once again threatening unity. Investors and analysts alike believed this week would finally display an agreement with OPEC+ about the next production steps. Almost three days of ongoing conversation and disagreement make this idea seem unlikely.

An unlikely partner – the Russian government – has now intervened and is reportedly trying to mediate talks between the Saudi’s and UAE so that production can be increased. Rising demand and the continued decline of oil stockpiles make an agreement necessary if the supply chain continues its ongoing rebound.

Today’s EIA inventory data showed that gasoline inventories fell more than expected. Crude stockpiles fell by 6.9 million barrels and are now 7% below the five-year average. Analysts suggested that they expected reserves to fall only by 3.9 million barrels. As summer demand increases, analysts suggest that these stockpile numbers could fall even further in the coming weeks.

This article is part of Daily Market News & Insights

Tagged: opec, Saudi Arabia, UAE, US shale

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.