Oil Prices Fall Before OPEC+ Meeting

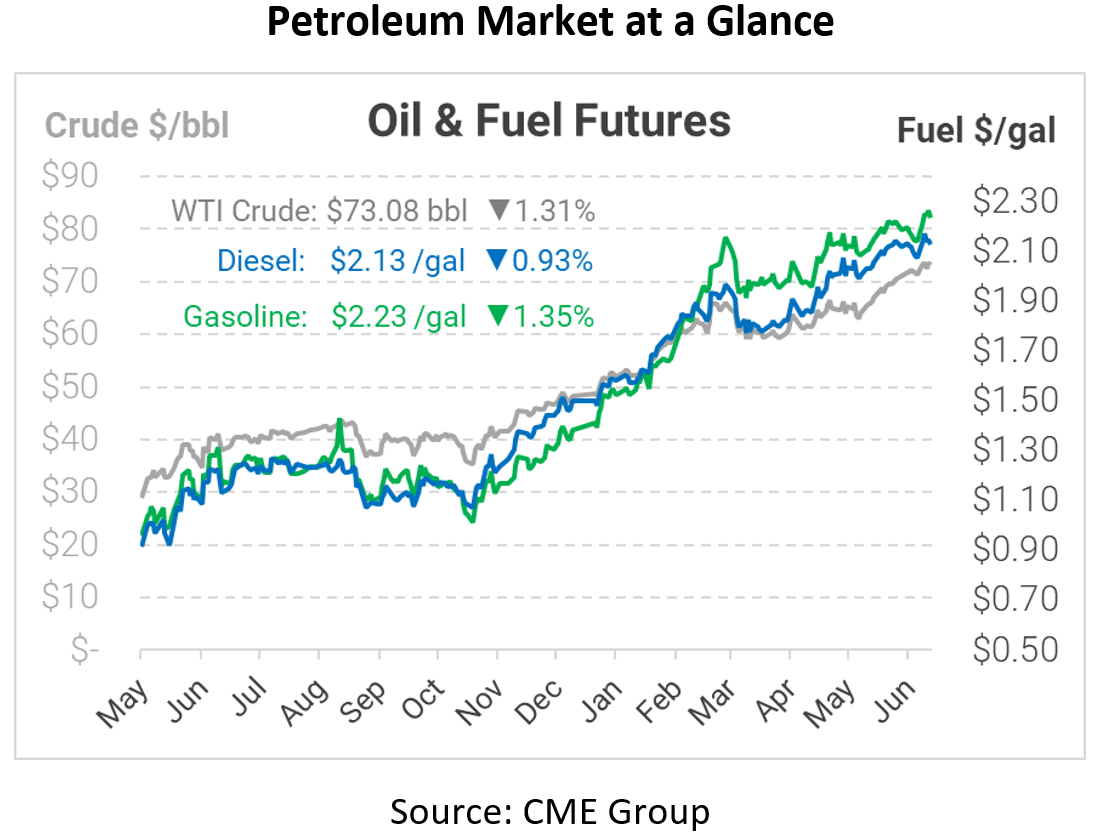

Today oil prices fell slightly after a previous week in which we saw prices climb to their highest in over two years. Crude opened the day at $73.99, diesel at $2.1480, and gasoline at $2.2625. These price droppings come ahead of the much-anticipated OPEC+ meeting later this week that is sure to stir the talking point of production output going forward.

With the recent rise in COVID-19 cases in Asia, the price rally many investors expected to see has yet to show. Despite volatility around the pandemic, many investors remain optimistic regarding OPEC+ and their plans for production output. Last week consumers still saw high prices due to the rising demand for summer travel and the addition of OPEC+ production cuts, and many forecasters point to a positive few weeks ahead. OPEC has started to ease up on the production cuts, now adding over two million barrels per day (bpd) to the market; and many marketers suggest the reasoning behind the production output increases could be linked to the massive supply shortage the world economy has seen with the rebound from the pandemic.

In other news, the United States and Iran continue to draw closer to a deal overseas. According to the U.S. Secretary of State Antony Blinken, discussions between the two administrations have been very positive. The main point of emphasis at meetings has been the nuclear deal, but there have also been talks regarding humanitarian policies and violence in Jerusalem. Over the next few weeks, an expected conclusion to the Iranian nuclear deal should bring long-awaited tranquility between the United States and Iran.

This article is part of Daily Market News & Insights

Tagged: COVID-19, Iran, nuclear deal, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.