OPEC+ Meets July 1 to Review Iran, Global Demand Trends

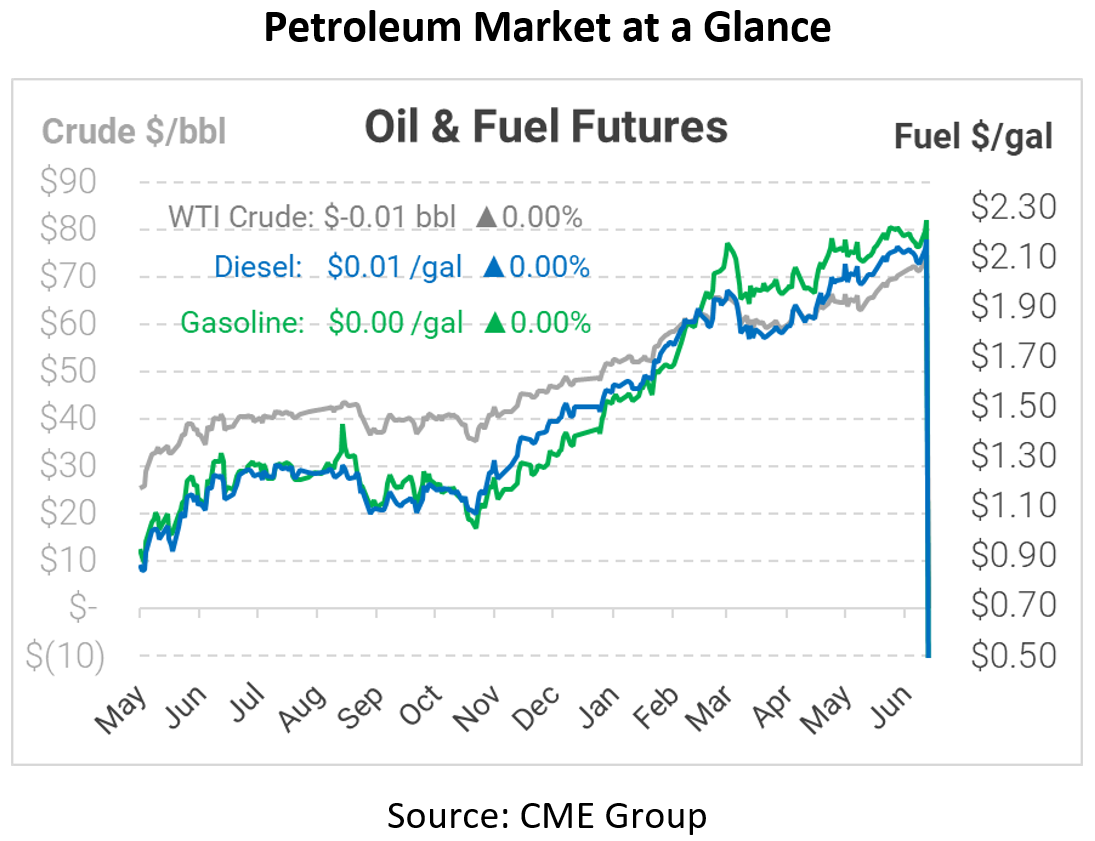

This morning, oil prices dropped, a reaction to prices hitting a new two-year high earlier this week. Today crude opened at $73.28, diesel at $2.1606, and gasoline at $2.2684. Lower prices early this morning are showing investors that higher demand, coupled with slow supply increases by OPEC+, could send prices in a positive direction.

The Energy Information Administration (EIA) stated that crude inventories fell by 7.6 million barrels. This was a fifth straight inventory decline and the lowest since March 2020. Inventory levels have concerned investors over the past few weeks, and oil demand around the world has been rapidly increasing thanks to the successful new vaccinations being distributed globally. Gasoline posted a surprise draw, showing that even with refinery throughput climbing, drivers are consuming much more gasoline than last year.

Expectation API EIA

Crude -3.9 MMbbls -7.2 MMbbls -7.6 MMbbls

Diesel +0.2 MMbbls +1.0 MMbbls +1.7 MMbbls

Gasoline +1.3 MMbbls +1.0 MMbbls -2.9 MMbbls

On July 1, OPEC+ will meet to review production levels and where they will go moving forward. Many analysts suggest that this meeting will end in a vote to further increase production, but only time will tell. So far, OPEC+ has shown surprising restraint, allowing prices to rise into the $70/bbl range. Past OPEC cuts have pushed oil to $50-$60; their limited upside was caused by swing production from the US. With US shale producers on the sidelines, OPEC+ has had free reign to push oil prices higher.

Once again, reports of the United States lifting sanctions on Iran have made headlines recently. While the United States has agreed to remove certain oil sanctions for Iran, there are still many moving parts that must be correctly in place before said sanctions can be officially lifted. Over the past few weeks talks between Iran and the United States regarding nuclear armament have been positive, according to government officials. However, according to U.S. Secretary of State Antony Blinken, “We are making progress, but there are still some nuts to crack.” Iran and the United States coming to terms on what will be done about Iran’s nuclear program will have massive implications on oil markets going into the future, and discussions seem to be moving towards an agreement.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.