Oil Falls Back on Rising US Dollar

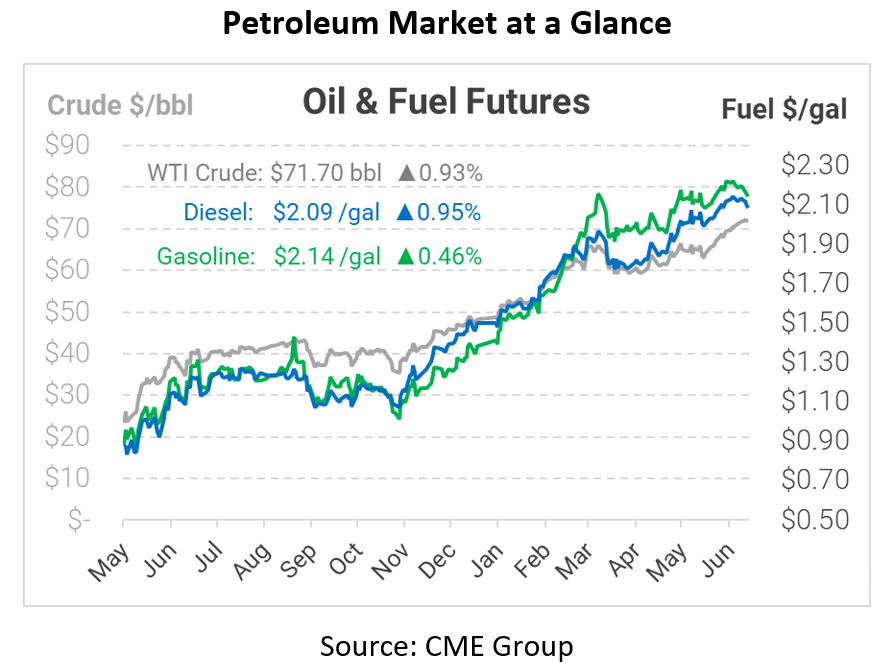

Oil prices fell early this morning on a rising US dollar, though prices moved higher as the morning continued. The Federal Reserve announced plans to hike interest rates in 2023, a year sooner than expected, due to rising inflation concerns. Any hint of higher interest rates is supportive for the dollar, since it would increase US bond markets and make US investments more appealing. As the dollar rises, oil prices fall as foreign traders cannot buy as many oil contracts with their local currencies.

Goldman Sachs responded to the dip in prices this morning, telling its customers that its bullish forecast is tied to physical product scarcity and not to inflation risks. With demand increasing and many global producers still hamstrung from the pandemic, Goldman expects crude oil prices to reach $80 in Q3, representing a roughly 20 cent increase in fuel prices.

Speaking of supply crunches, OPEC is closely monitoring the return of US production, and according to Reuters all signs point to limited production growth from American shale. After years of high growth but very low cash returns, US companies are focusing now on debt reduction and cash accumulation rather than pumping more at all costs. Sources point to a 200 kbpd growth in US output this year, which would put production neatly 1.5 MMbpd below pre-pandemic levels.

This article is part of Daily Market News & Insights

Tagged: opec, US Dollar, US production

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.