2021 Oil Forecasts Rise as Iran Deal Stalls

Lack of progress on Iranian nuclear negotiations is pushing markets to fresh highs this morning. Iran’s presidential election, which had been seen as a soft deadline for negotiations, is approaching on Friday this week. The front-runner is Ebrahim Raisi, a hard-line conservative with a history of cracking down on political opposition. Iran’s Supreme Leader Ali Khamenei, who holds most of the political sway in Iran, supports negotiations, so progress is expected regardless of the presidential outcome. Still, missing this first unspoken deadline shows that a resolution will be tricky to reach.

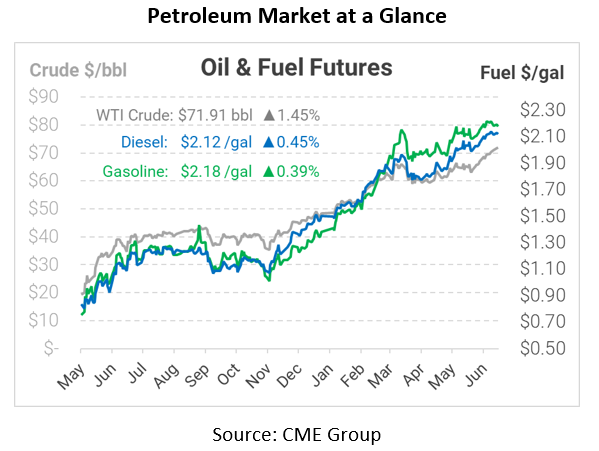

For companies evaluating their budgets midyear, slow progress from Iran may be glum news. Energy commodities trader Vitol sees oil prices hovering in the $70-$80 range for the remainder of 2021. Moreover, they note that oil prices are more likely to go up than down, possibly hitting $100/bbl this year. For fuel prices, every $10/bbl move in crude oil equates to roughly 40 cents for fuel prices – so prices rising to $80/bbl would bring a significant fuel cost increase. If crude were to hit $100/bbl, fuel prices could easily rise above $3/gal.

Optimism related to COVID vaccination rates has helped spur the rally. The US and other developed countries are committing to delivering vaccines to delivered countries, increasing accessibility. Demand data is showing a recovery for fuel products, and OPEC seems intent on maintaining their current strategy. At this point, OPEC holds all the cards – if they hold to their current strategy, expect prices to continue climbing this year. If they reverse course and ease up on restrictions, prices could stay balanced at current levels for the rest of the year.

This article is part of Daily Market News & Insights

Tagged: Iran, Oil Forecast, sanctions

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.