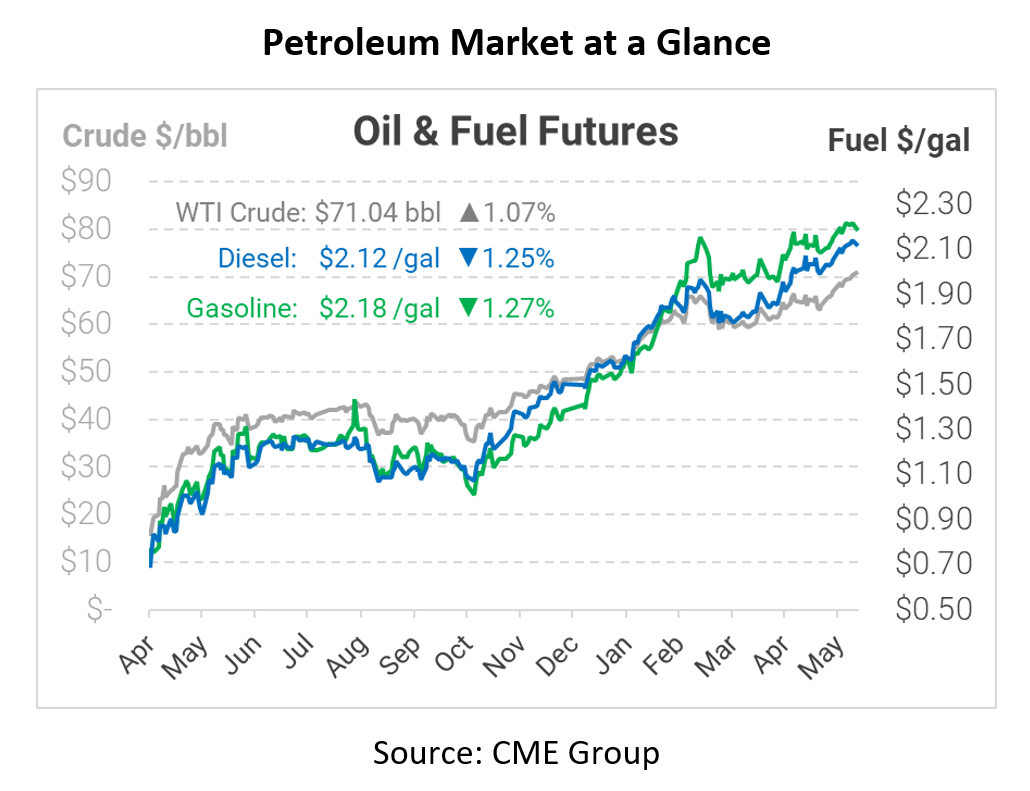

US Crude Hits Fresh 2.5-Yr Highs as Goldman Calls for $80 Oil

Oil prices reached a fresh high yesterday, spurred higher by demand optimism. Goldman Sachs reiterated its bullish forecast to its customers, stating that Brent crude prices may overshoot their $80/bbl price target. Given where prices are today, that forecast suggests at least another 20 cent per gallon increase in fuel prices before the end of the year.

Yesterday, an erroneous headline that the US had lifted sanctions on Iran caused oil prices to fall by a dollar. As markets realized the sanctions were on Iranian individuals and unrelated to the on-going nuclear negotiations, prices began climbing once again to their multi-year high. The brief selloff hints at what could occur when a US-Iran deal is reached. Iran officials believe they can nearly double their output, from roughly 2 MMbpd to 4 MMbpd, within 90 days of sanctions being lifted. Although most analysts expect global markets to be able to absorb the supply, a nuclear deal would reduce the risk of excessive price gains later in the year.

The IEA also released a bullish forecast, calling for oil demand to surpass pre-pandemic by the end of 2022. Notably, the IEA expects oil demand to outpace supply even with Iranian supply added to the market. The IEA expects the world to require 44 MMbpd from OPEC by the end of 2022; given current cuts, full Iranian output would take the group to just over 43 MMbpd. That mismatch will cause inventories to continue falling around the world, putting upward pressure on fuel prices.

This article is part of Daily Market News & Insights

Tagged: crude forecast, IEA, Iran

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.