Crude Nears $70/bbl – US-Iran Talks Continue

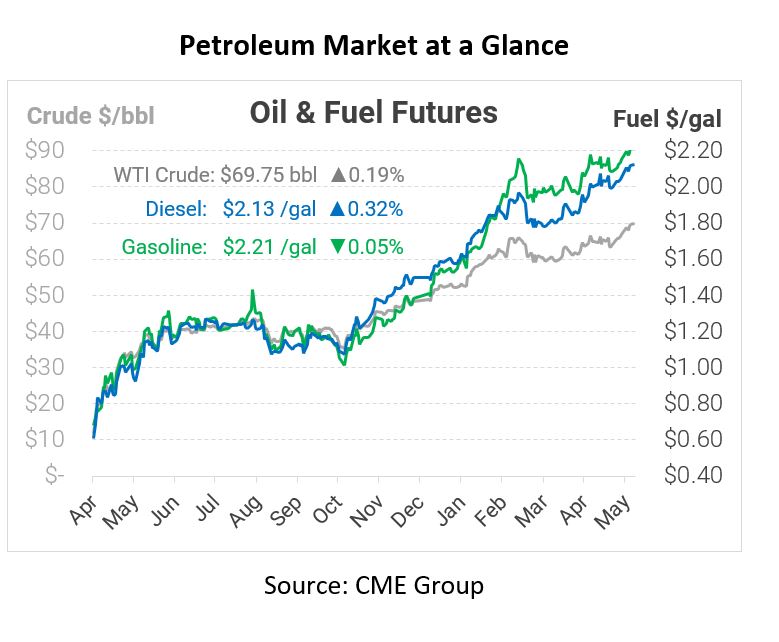

This morning crude opened at $69.52, the highest in a multi-year period. While crude is floating around $70, it may be a while before it breaches that threshold. With the economy trying to find a strong balance between the rising demand with summer travel picking up, along with higher output from Iran, there are differing opinions on what the market will do to prices in the coming weeks.

Talks between Iran and the United States are still ongoing and are predicted to continue for quite some time. During this period of negotiations, many have suggested that this new deal could send energy prices higher even with more supply in the market. Damien Courvalin, a senior commodity strategist at Goldman Sachs says, “While it appears to be contradictory, a deal that brings Iranian barrels back to the market could actually see oil prices rise.” His reasoning for this mostly stems from when oil prices rose in April after OPEC+ stated that they would add back 350,000 barrels a day in order to raise output. While many do believe that this hovering deal could pose new oil price highs, they are certainly not met without opposing views.

For many with the opposite view, they say that this deal could potentially lower prices at least for the short-term. According to Morgan Stanley in a research note, “an increase in Iranian exports will probably cap Brent crude at $70 per barrel and expects the international benchmark to trade between $65 and $70 per barrel for the second half of 2021. Our view is that the initial reaction to a potential deal will be a brief sell-off.” Back and forth concerns over the Iranian deal will come to life in the coming weeks when a deal is officially met, but until then prices will continue to react to the changing market conditions that summer demand is ushering in.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.