Crude Oil Hits 3-Yr High on Strong Economic Data

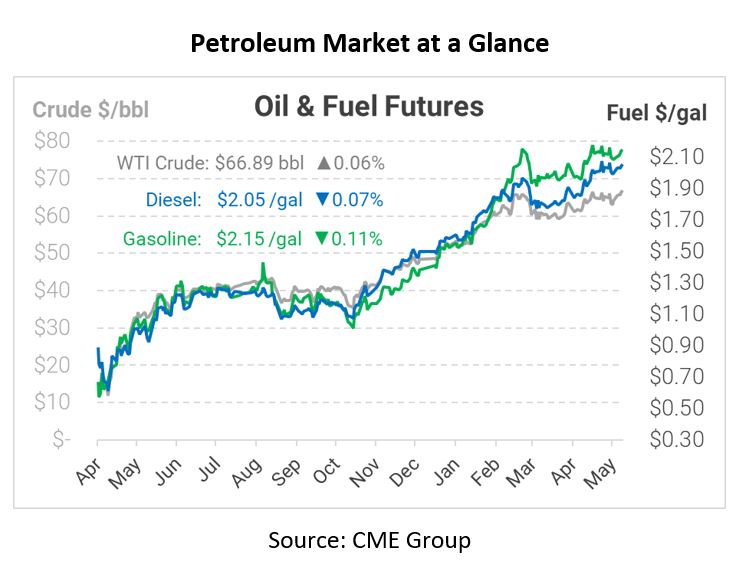

Oil prices climbed to three-year highs at yesterday’s closing price, with WTI crude settling at $66.85. Today, fuel prices are peaking above multi-year highs as well, after hovering near the high for the past two weeks. The Commerce Department reported that US GDP growth was 6.4% last quarter, a clear sign of demand recovery.

Memorial Day weekend is now upon us, and analysts estimate that over 34 million Americans will hit the road over the next few days. Gasoline prices around the US, spurred higher by the retail fuel shortages during the CPL outage, are at their highest level in years. As summer driving season kicks off, global demand is expected to climb back above 100 MMbpd in Q3. Although that’s still not quite as high as pre-COVID levels, it’s much higher than forecasts one year ago projected.

The recovery has altered the pre-COVID trends of fuel consumption. China, once the center of all oil demand forecasts, is being left behind now that western countries are ramping up demand. According to a Goldman Sachs report, stimulus bills passed in the US and Europe are driving a flurry of activity, while China has been slower to recover. With commodities of all types rising in costs, developed countries with more disposable income can afford to bid up prices, while lower GDP per capita countries cannot keep pace.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.