Oil Settles Higher on API’s Inventory Draw

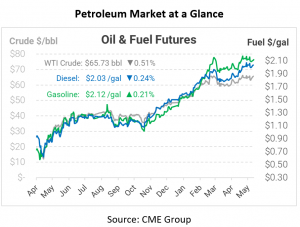

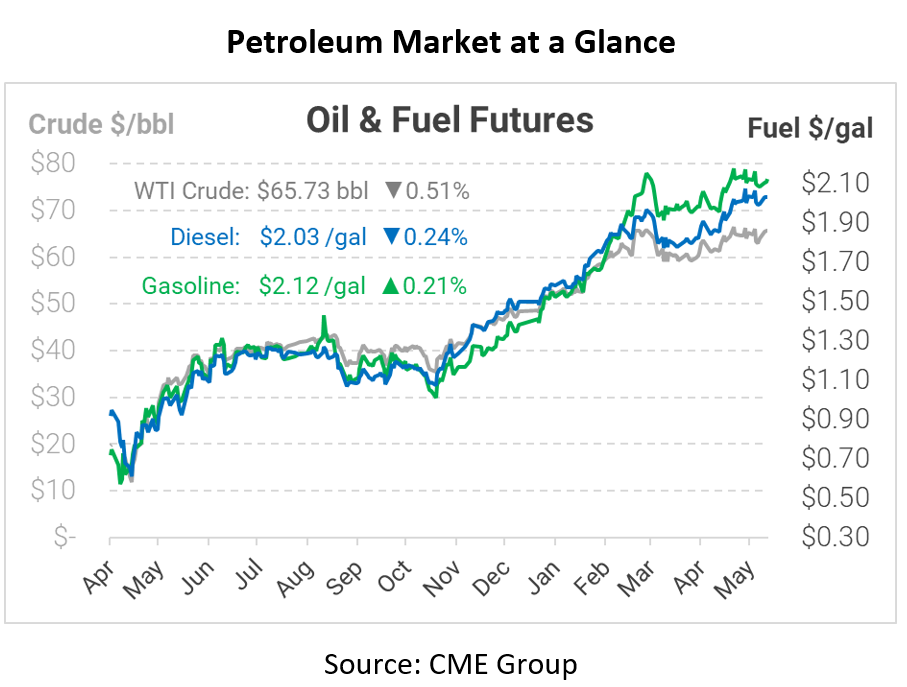

Despite a slow start yesterday morning, oil prices closed the session a few cents higher than Monday’s close, putting prices at the top of its recent $63-$66 range. Today, prices are trading sideways/slightly lower, recovering from the rally over the past two days.

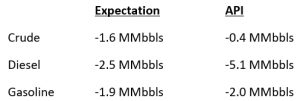

The API released their weekly inventory data, which echoed the market’s expectation of across-the-board inventory draws. Crude inventories reportedly fell 0.4 million barrels, a bit below expected levels. Markets will be watching the EIA’s data later today to confirm inventory directions. The data is important on two levels – 1) it’s the second report from the Colonial cyberattack, and 2) as demand recovers, markets are watching to see how supply/demand balances perform.

Speaking of the Colonial cyberattack, the White House is moving forward with mandatory cybersecurity reporting requirements for pipelines, the first time those companies have been mandated to report cyberattacks to the federal government. Further mandates are expected in the future to secure America’s critical infrastructure against cyberattacks. The TSA, the agency tasked with pipeline protection, will lay out guidelines for how pipeline companies protect their critical systems and what to do during an attack.

This article is part of Daily Market News & Insights

Tagged: API, Cybersecurity, Inventories, Range-bound

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.