US & Iran Move Closer to Nuclear Agreement

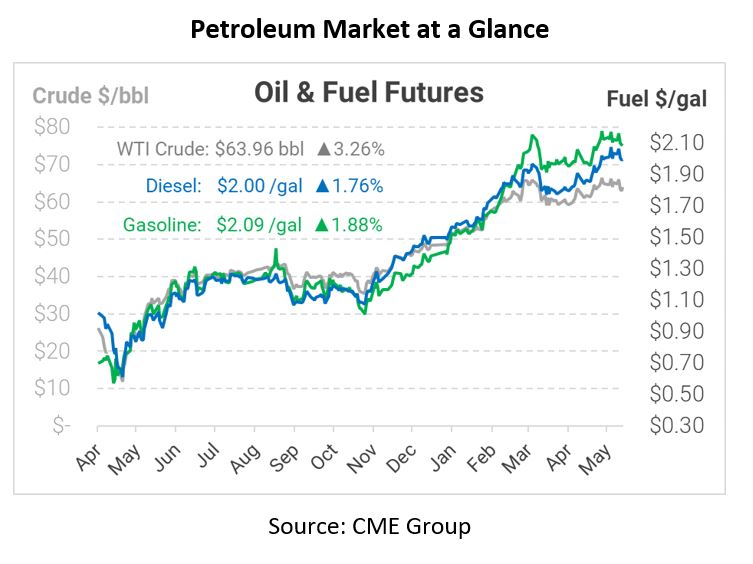

Oil markets yesterday broke out of the narrow range held since late April, with WTI crude falling to $62/bbl at closing time. This morning, prices seem to be breaking the three-day down streak, with crude prices up by nearly a dollar and fuel prices gaining around three cents per gallon. With Memorial Day (the unofficial opening of summer driving season) around the corner and Europe reopening, markets are optimistic that oil could move higher, despite new progress in US-Iran negotiations.

US and Iranian negotiators are working towards an agreement to lift US sanctions and bring Iran’s nuclear program back into international compliance. Yesterday, Iranian President Rouhani claimed the “main agreement” has been resolved, so negotiators will now haggle the details. However, US officials have taken a less rosy tone, noting that “many challenges” remain.

According to Platts, Iran pumped 2.4 million barrels per day (MMbpd) last month, roughly 1.5 MMbpd off from their pre-sanctions max production level. Production fell even lower in 2020 during the pandemic but has since recovered thanks to Chinese purchasers skirting sanctions. Adding all the extra supply to global markets will cause prices to fall, though the global economic rebound will keep upward pressure on markets.

This article is part of Daily Market News & Insights

Tagged: crude, Iran, nuclear agreement, Platts, WTI

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.