IEA Drops Curveball Report, Inflation Fears Rise

This week the International Energy Agency (IEA) dropped a surprising report encouraging no new oil and gas investments after 2021. The statement followed a net-zero emissions summit, which set a goal of net-zero emissions by no later than 2050.

According to the IEA, the only way to achieve a net-zero emissions target by 2050 is to cease all fossil fuel investments, other than those already approved for this year. The IEA is encouraging investors to funnel investments into renewable energy varieties to start the path toward changing the oil and gas industry. Along with this suggestion, the IEA also recommended against new coal mines, which they say would be counterproductive to achieving net-zero emissions.

Assuming a rapid transition toward net-zero emissions occurs, demand for fossil fuels is expected to make a sharp decline. Oil demand would drop as much as 75% to just around 24 million barrels per day (MMbpd) as opposed to the 100 MMbpd in recent years. Of course, this projection is long-term. In the short-term, transitioning to renewable energy would require more mining of rare earth minerals, more manufacturing of renewable power sources, and more transportation of equipment. With these short-term needs in mind, it’s challenging to imagine how the world would cease fossil fuel investments next year, before new renewable projects actually come online.

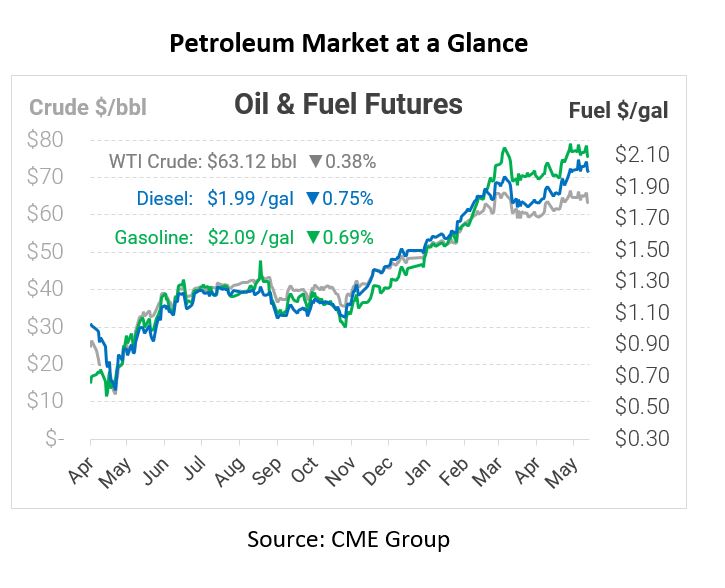

As of recent, there has been much talk about the possibility of inflation in the United States economy as the country continues to rebound from COVID-19. With the price of oil, automobiles, and consumer goods sharply increasing, rapid inflation has started to become a bigger threat that many people cannot look past.

A prolonged period of high inflation has not occurred since the early 1970’s, but it has been worrisome to some nonetheless. Commodity and consumer prices have been rising for several months now, and it looks to be on that trend for the next few months. When the COVID-19 pandemic ripped through the United States economy last year, prices took a steep hit in March and April 2020. While the economy is recovering, year-over-year price increases are shocking consumers.

This week the Federal Reserve’s Open Market Committee met and discussed this threat of inflation in depth. Minutes released this week from their April meeting show that the U.S. central bank is considering moving past its current monetary policies and bond-buying programs. These programs and policies were implemented to provide an economic boost during the pandemic, but with the economy showing signs of over-heating, it may be time to remove the supports. If the Fed slashes its bond-buying program and raises interest rates, it would be harder for companies to borrow money, slowing business activity. While tough for businesses, it would also reduce oil demand, causing oil prices (and other commodities) to fall.

This article is part of Daily Market News & Insights

Tagged: COVID-19, IEA, Inflation, oil demand

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.