Oil Prices Rally – Gas Stations Still Shut Down

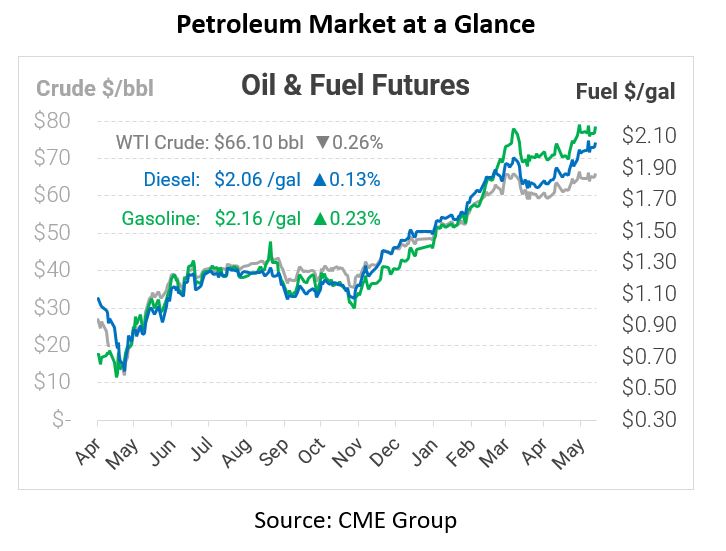

This morning the price of crude passed $70 as COVID-19 restrictions loosen around the world and investors predict demand for oil to soar in 2021. Prices have been dipping recently as a result of COVID cases’ surging in Asia and the reopening of the Colonial Pipeline (CPL), but there are optimistic signs of recovery in the United States and abroad.

With the introduction of vaccines into the world marketplace, restrictions are being lifted in order to increase travel and economic activity. This week the Transportation Security Administration (TSA) reported that their screenings nationwide hit a 12-month high of 1.85 million. The rising number of screenings across the United States for international and domestic travel – along with the Memorial Day holiday around the corner – makes a strong case for oil supply and demand to level.

With the Colonial Pipeline (CPL) now fully operational, consumers in commercial, government, and retail sectors are seeing a gradual improvement in the supply situation, though long-hauls, long lines at terminals, and retail outages are still prevalent across the Southeast. Until low inventories at terminals across the region are restored, what product does become available will quickly be depleted by marketers and consumers.

On Monday the national average price of gasoline was $3.045, the highest price in over eight years, and there were still approximately 11,667 gas stations without fuel nationwide. Panic buying has disrupted the majority of gasoline supply, especially in the Southeast, and tight supply is still expected for the majority of this week. Alpharetta-based CPL has been shipping this week at normal rates, but the supply chain must be given time to catch up with the rising demand.

This article is part of Daily Market News & Insights

Tagged: Colonial Pipeline, COVID-19, Oil price

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.