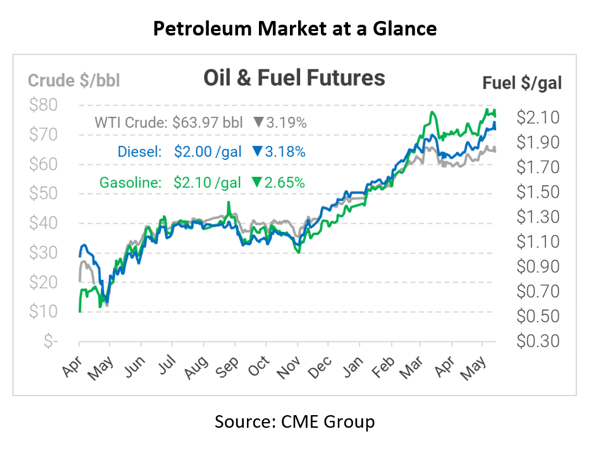

Oil Deflates as Pipeline Reopens, Inflation Fears Persist

After racing back above $66/bbl yesterday, US crude oil prices are falling back once again this morning. Inflation concerns are heating up, with the US Labor Department reporting that consumer prices rose 4.2% in April – the fastest growth since 2008. Higher inflation would seem to promote higher fuel prices, but it also leads the Federal Reserve to raise interest rates, causing investors to flood from risky assets like stocks and commodities into safer bond markets. Commodity markets across the board are falling lower today.

The Colonial Pipeline resumed operations last night, noting in a press release that they hoped to begin delivering to markets as quickly as possible. They also noted, however, that it could be several days before supply conditions improve. Bloomberg reported that the pipeline paid a $5 million ransom fee in cryptocurrency hours after the attack to get the pipeline back online, and then spent several days checking for pipeline integrity before restarting. Markets will closely watch the EIA’s data next week to see how severely the outage impacted national and PADD 1 fuel stocks.

Further north, the Enbridge pipeline said it would continue its operations, bucking an order from Michigan’s governor to close down for environmental reasons. The decision will certainly bring litigation to decide whether Michigan has a right to regulate the pipeline, which crosses several states and spans the US-Canada border.

This article is part of Daily Market News & Insights

Tagged: Colonial Pipeline, crude, diesel, gasoline, Inflation, pipeline, US Labor Department

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.