Oil Near Multi-Year High as Countries Loosen Restrictions

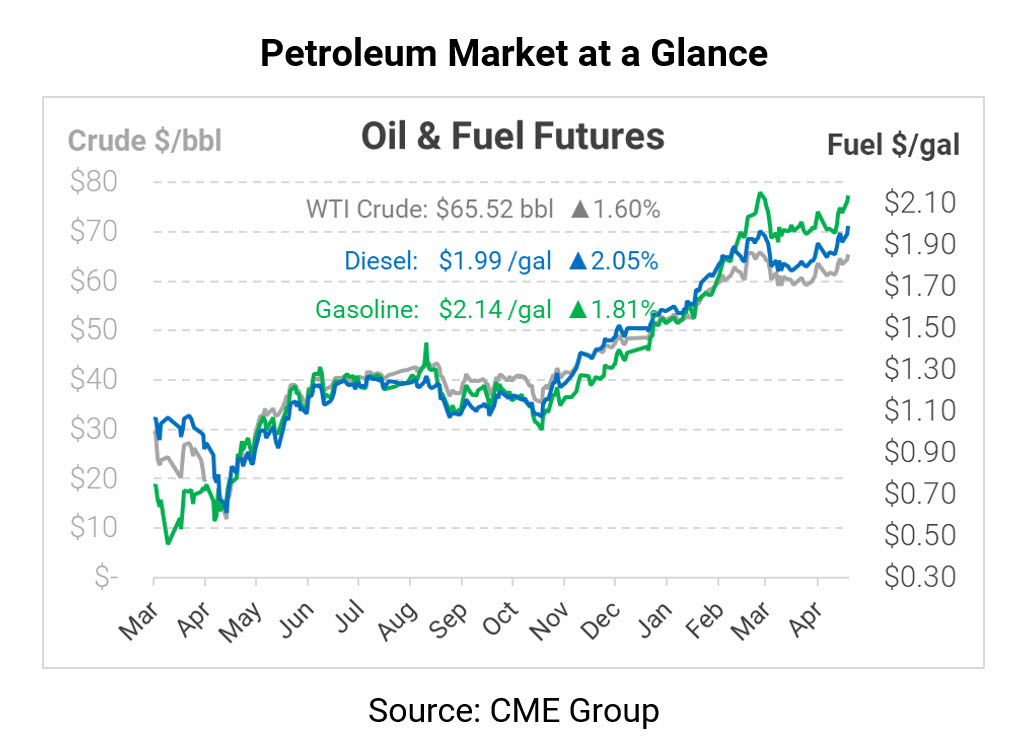

Oil prices are continuing their vaccine bounce this morning, pushing above $65 while fuel prices are setting fresh multi-year highs as well. The European Union is working on loosening restrictions for vaccinated travelers in time for the summer tourism season. Simultaneously, US areas like New York are also unwinding tight restrictions. Although cases are rising in some areas of the world, the most demand heavy areas – the US, EU, and China – are allowing travel and commerce to resume. The impact on fuel demand will be clearly reflected in fundamental EIA and IEA data over the next few months.

The major question now is how OPEC will react to rising demand. The group currently has agreed to moderately increase production over the next three months, giving markets some certainty for the next few months. As demand picks up, that assurance will keep prices elevated. However, OPEC+ can always change its approach and increase production faster, providing some relief from higher prices. Developing nation COVID cases and US-Iran negotiations will be important factors in their decision. It’s too soon to say how OPEC+ will react to rising demand, but assuming they stay the course, prices are likely to keep rising for the next few months.

For US oil producers, stricter regulations could be coming in the future. Last week, Senate Democrats used the Congressional Review Act to repeal Trump’s deregulations, including an action restricting the EPA from limiting methane emission from oil & gas wells. The Congressional Review Act allows a new Congress to undo executive action passed at the end of a former president’s term with a simple Congressional majority. In 2017, the law was used by Republicans to repeal many Obama-era regulations.

The Trump-era methane rules were set in 2020, so they barely had time to take effect before being rolled back. Oil and gas production clearly flourished in the years before the new rules, so this particular action won’t hamstring America’s oil recovery. But it does show that Democrats are taking action on their climate agenda, which could have more serious production implications down the road.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.