World Rallies to Support India

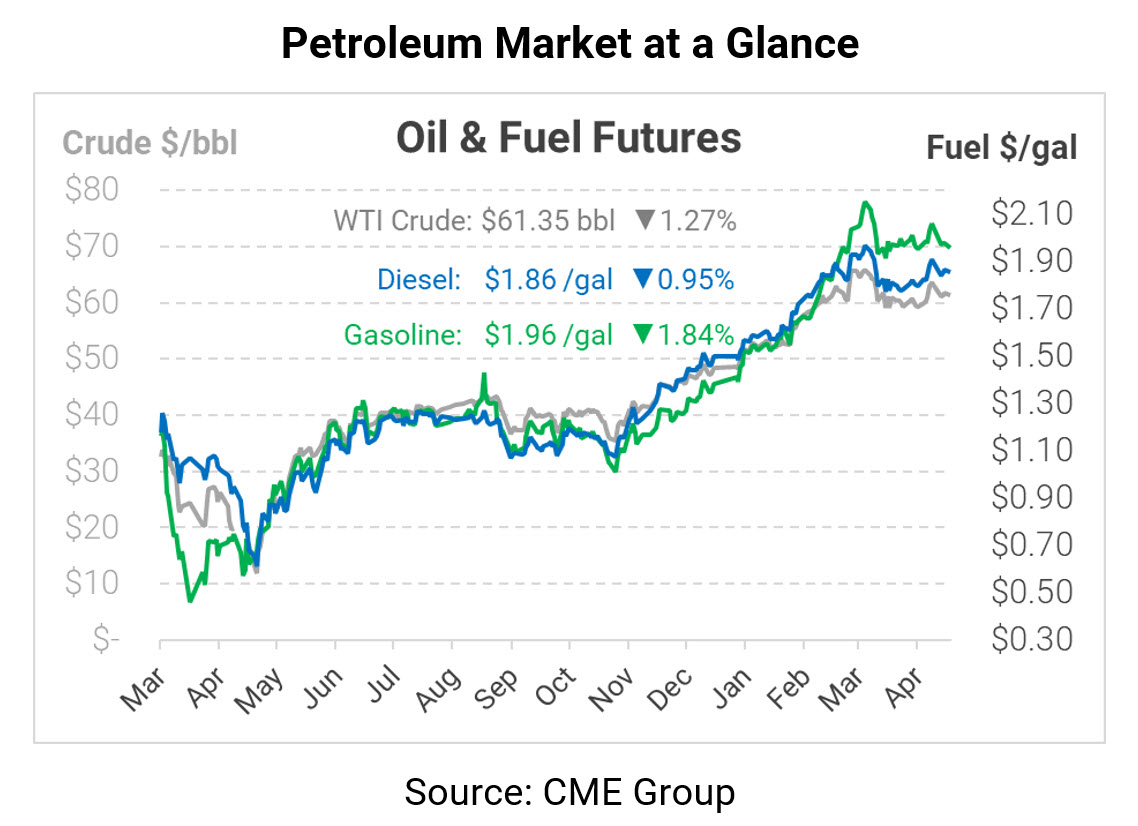

Friday’s late-breaking rally is unwinding this morning, with concerns over COVID cases in India dampening sentiments. Friday saw WTI crude prices pop above $62/bbl, but this morning those gains have disappeared. In addition to growing COVID, OPEC’s production hikes go into effect on Saturday, so global markets will need to absorb more oil. OPEC+ will meet later this week to review market conditions, but analysts do not expect any change in their output approach. Saudi Arabia will phase in its production over the next two months after voluntarily cutting an extra 1 MMbpd for months.

India’s situation continues deteriorating, with the country announcing another record-breaking 350,000 this morning. The international community has committed to action, with the US and UK promising to send medical supplies. China has also offered aid, though so far India has not taken the country up on its offer. Earlier this year, President Biden imposed a controversial medical export ban that blocked vaccine components from being sold to other countries. The administration has partially lifted the ban, allowing aid to move to India.

California last week announced plans to evaluate phasing out all oil and gas production by 2045, beginning with a ban on new fracking permits within the next three years. California has previously set a goal of banning gasoline-powered cars by 2035. California produced 364 kbpd in January, making it the 7th largest producing state. Losing California’s oil production wouldn’t be a devastating blow to global oil trades, but its precedent could. California sets the tone for many other states around the US, and a California ban could provide a model for environmentalists seeking a federal ban on production. It’s a long-term goal, and the fracking ban would impact less than 5% of California’s output. Still, the potential production ban is worth monitoring to see how it spreads to other states – and even other countries.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.