Stronger Demand Projections Spurs Higher Prices

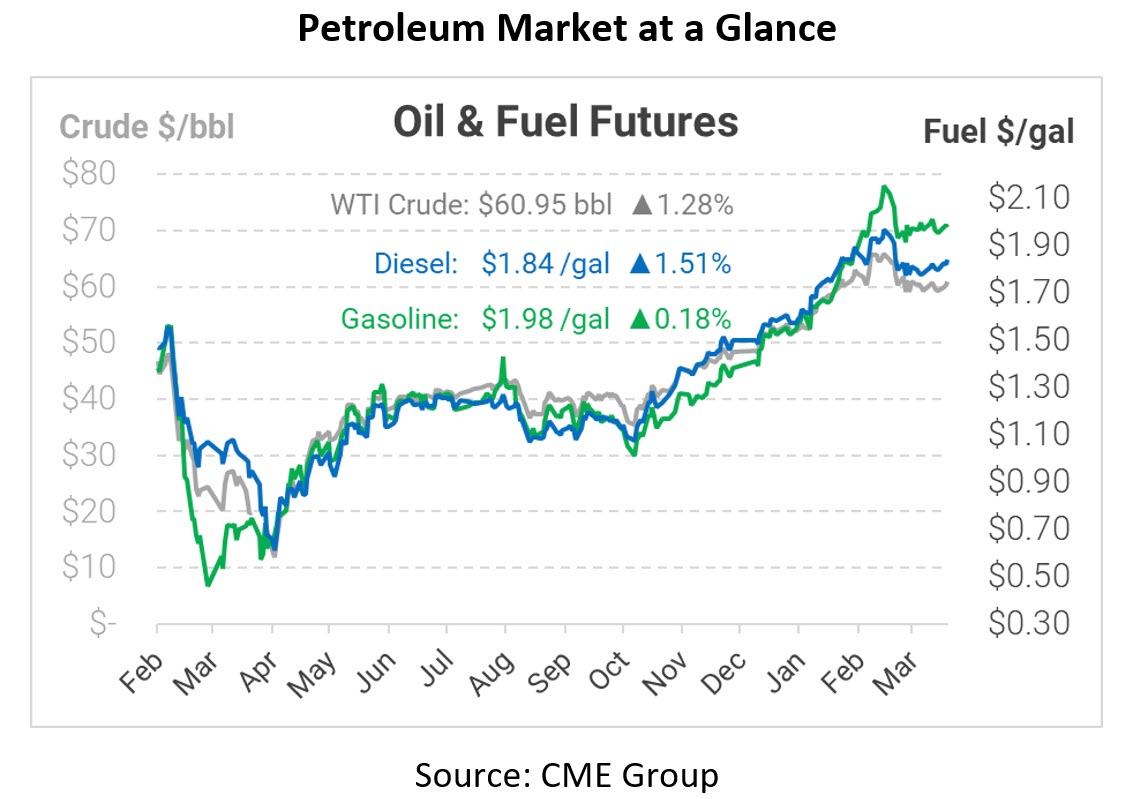

Oil prices are inching higher this week, breaking out of the narrow trading band last night to close above $60/bbl for the first time in nearly two weeks. Supporting prices today, OPEC increased its forecast for 2021 global demand growth by 70 kbpd. While that figure isn’t particularly astounding, any increase tells markets that the future is looking brighter. In its monthly report, IEA raised US demand by 365 kbpd in the second half of 2021, while Chinese demand rose by 160 kbpd. The IEA also quelled concerns of an impending supply crunch, noting that OPEC has some 6 million barrels per day of spare production capacity it can tap into.

The API released their weekly inventory numbers last night, with the EIA’s numbers coming later this morning. The report brings a mixed outlook – although the sizeable crude and diesel draws suggest tight markets and higher prices, the large gasoline inventory build may temper trading.

US crude production is gradually showing signs of recovery, no thanks to the winter storm in February that set the industry back by almost a million barrels per day temporarily. The Permian oil basin has seen production rise to 4.47 MMbpd, moving closer to its pre-pandemic level of 4.87 MMbpd. The Permian has remained a bastion of production as other production areas fall. Total US crude production is off by 2 MMbpd from the 13 MMbpd peak before COVID. Although the industry is recovery, some believe US output will never rise back to pre-COVID levels, especially because it would take too much additional capital to expand drilling that much.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.