What’s Going On with Iran?

Iran may be the next major talking point for oil markets. President Biden is attempting to revive the nuclear deal with Iran, which would including lifting sanctions that are keeping millions of barrels of oil off the market. The Joint Comprehensive Plan of Action (JCPOA), signed in 2015 by former-President Obama, was exited in 2018 when former-President Trump reimposed sanctions on Iran, leading Iran to reignite its nuclear program. Now, the US and Iran are slowly working towards negotiations to reign in Iran’s nuclear program and lift crippling economic sanctions.

There’s a long road ahead. So far, Iran has opposed any negotiations or gradual sanctions relief, insisting that all sanctions be lifted immediately. The US has insisted on good-faith negotiations before sanctions are lifted. Five countries – Russia, China, Germany, France, and Britain – are meeting with Iran this week in Vienna, while the US is beginning its own indirect communications with Iran. What will that mean for oil prices?

Between 2015-2018, Iranian oil exports averaged above 2 MMbpd, sinking below 0.5 MMbpd in 2019. Many believe that exports have since creeped higher, going to countries like China and Venezuela. If sanctions were lifted, Iran would be free to fully increase production once again. In addition to increasing supply, a deal would also reduce geopolitical risk. Both the US and Iran have seized oil tankers in key water channels near the Middle East; that tit-for-tat would likely slow once a deal is in place.

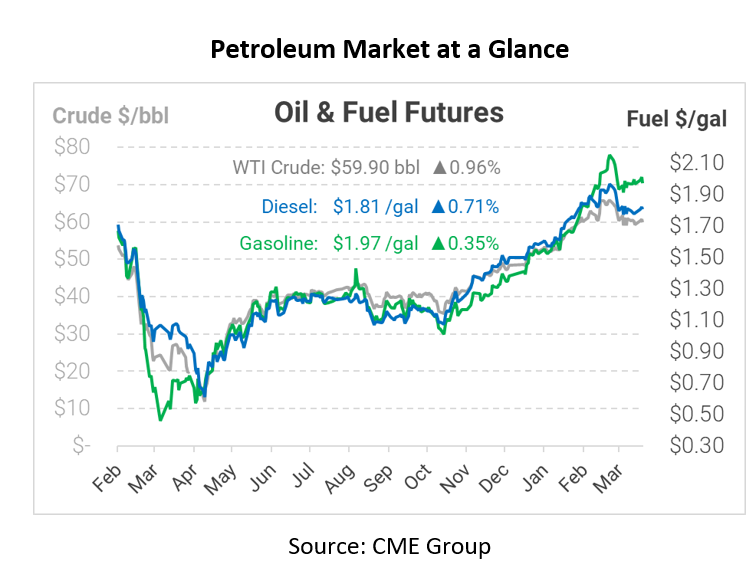

Goldman Sachs estimates that a deal likely won’t materialize until 2022; if it occurs sooner, the bank believes it would cause oil prices to fall by $5/bbl (roughly 12 cents per gallon). OPEC’s response must also be considered – they may choose to restrict output elsewhere to accommodate the new supply. It’s hard to say for sure what the impact will be, given the different factors at hand…but most agree that a renewed Iran nuclear deal would be beneficial for global security and for fuel consumers.

The API released their weekly data inventory yesterday, which was bullish for crude but bearish on the products side. Crude inventories fell by 2.6 million barrels, while diesel and gasoline each posted sizable builds. Markets shrugged off the news, waiting instead for the EIA’s report this morning to validate market trends.

This article is part of Daily Market News & Insights

Tagged: Inventories, Iran

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.