Inventories, Infrastructure, and OPEC – Oh My!

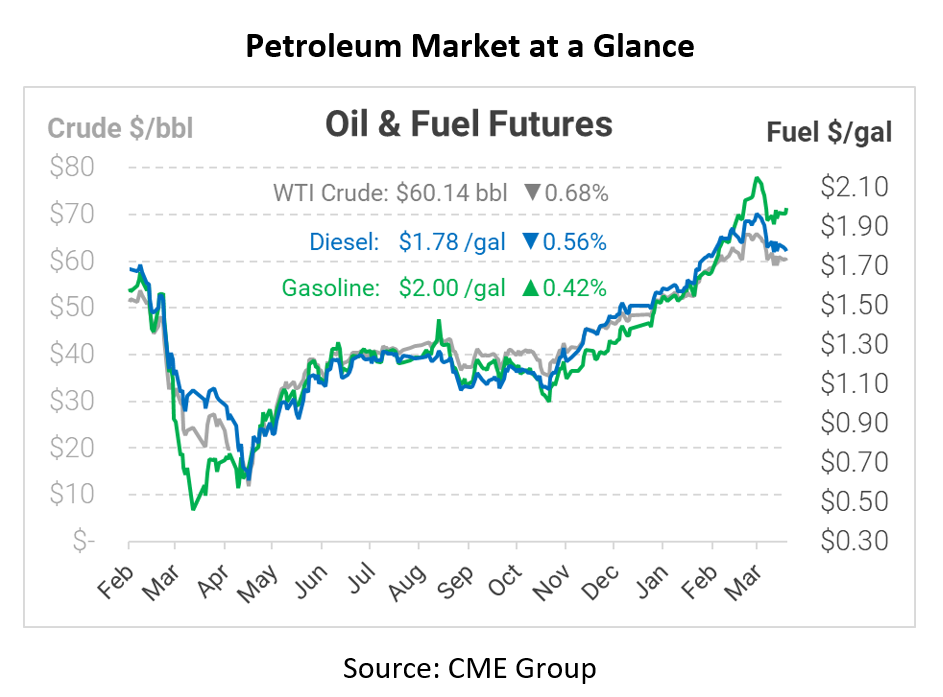

After pulling back moderately yesterday, oil markets are trading steady as they await the EIA’s weekly inventory data, Biden’s new infrastructure plan, and more news regarding OPEC’s future production strategy. So far, OPEC members seem aligned on maintaining their current strategy. A month ago, the group was scorned for maintaining cuts in the face of a presumed demand recovery; now, they feel their decision paid off. Europe’s COVID resurgence has weakened demand, putting pressure on oil prices. Given continued weakness, OPEC members are eager to maintain their current revenues and avoid a broad price collapse.

While OPEC’s cuts seem to be providing a floor for oil prices around $60/bbl, the API’s inventory data took a bearish slant. The report showed crude oil inventories rising by 3.9 million barrels, compared to expectations of a meager gain. Diesel stocks also posted a larger-than-expected build. On the flip side, gasoline inventories saw a strong surprise draw of 6 million barrels. Markets will wait for the EIA’s data later this morning to decide how to react to the fundamental news.

President Biden is rolling out a $2 trillion infrastructure plan, which markets are expecting to add to economic growth. Nearly 1/3 of the bill will go to improving America’s roads, bridges, transit, and other transportation infrastructure. In addition, hundreds of billions would be devoted to housing, manufacturing, digital infrastructure, Medicaid, and workforce development. Beyond basic infrastructure improvements, President Biden will roll out clean energy initiatives including investments in electric vehicles and wind power turbines.

Although the bill will be rolled out today, it will likely face months of scrutiny in Congress, so don’t expect any major changes soon. For oil prices, the shift to alternative fuels could cause oil demand to drop, causing oil prices to go down slightly over the long-term. On the flip side, building all those roads and bridges – and adding millions of new daily commutes to work as jobs grows – would increase fuel consumption in the near-term, so the short-term result of the bill would likely be robust price gains.

This article is part of Daily Market News & Insights

Tagged: Biden, COVID, Infrastructure, Inventories, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.