Why Oil Prices Fell 10% This Week

Oil markets saw a massive selloff yesterday, with losses exceeding 10% at one point. Rather than being concentrated at one time, the downward pattern stretched throughout the trading session. By the end of the session, crude oil had shed 7%. The massive downturn didn’t seem to have a particular catalyst, though a few different factors contributed:

- European lockdowns due to COVID and delays in vaccine deployments

- Rising interest rates and a slightly higher US dollar

- Across-the-board inventory builds for crude and refined products

- Technical factors including crude breaking below its 20-day moving average for the first time since November 2020

- The IEA’s recent report highlighting the fragility of the oil market rally

With no clear cause, it’s hard to say whether yesterday’s movement was a blip in an otherwise strong rally, or whether it begins a new trend. Market fundamentals are still largely the same – demand is growing stronger thanks to vaccines, and OPEC+ remains committed to balancing markets. As long as OPEC+ holds to their cuts and American producers don’t suddenly ramp up output, there’s no reason to believe the recent rally is out of steam.

A good rule for financial markets is “what comes up, must come down.” After a relentless price rally marching on since November 2020, it was only a matter of time before a sharp break came. Traders who bandwagoned during the rally needed a chance to sell their holdings and take profits. Once oil fell below its 20-day moving average, more traders jumped in. The next key level of support is the 50-day moving average, currently at $58/bbl. If crude oil falls below that level, it could suggest a more significant break from the vaccine rally.

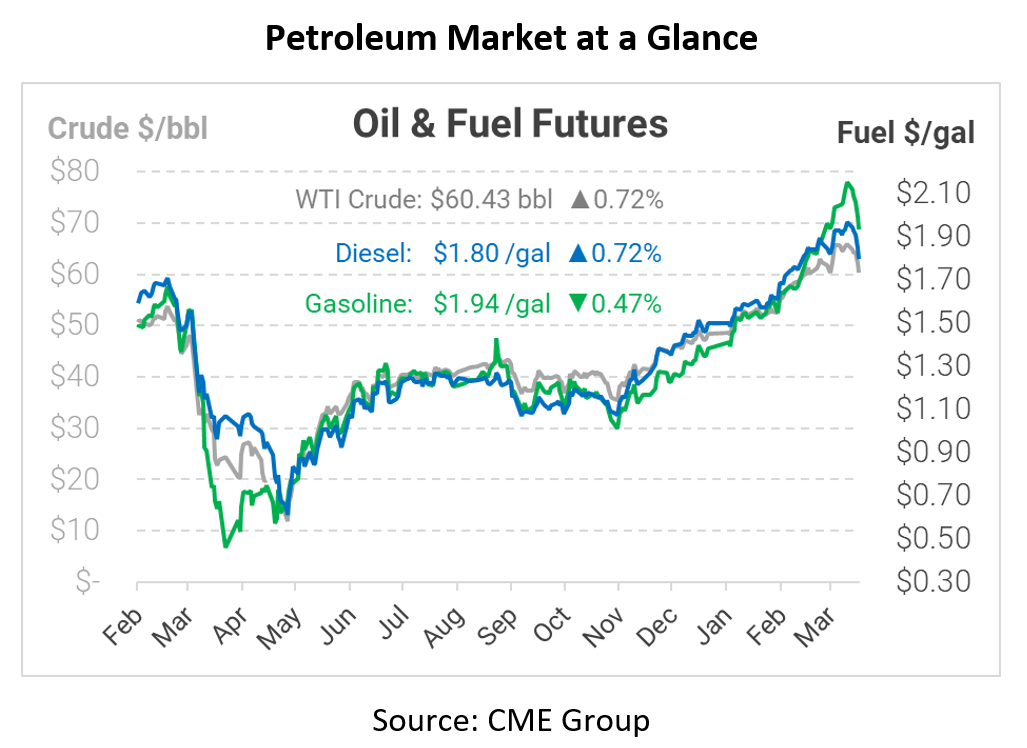

Oil prices have been wabbly this morning, fluctuating between meager gains and large losses. Currently, the bulls are prevailing. Crude oil is trading at 60.42, up 43 cents from Thursday’s closing price.

Fuel prices are mixed. Diesel is trading at $1.7970, up 1.3 cents. Gasoline is trading at $1.9350, down another 0.9 cents after yesterday’s sell-off.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.