Stimulus Bill Will Also Stimulate Oil Demand

Thursday brought a huge up-trend for oil markets, supported by the passage of the $1.9 trillion stimulus package in the US and a bullish monthly report from OPEC. The stimulus package was signed on Thursday by President Biden, providing a huge financial injection for the economy and more funding for vaccine distribution. The Wall Street Journal estimates the legislation will boost US GDP up to 5.95% this year, the fastest growth since the 1980s. It will also buoy inflation to an estimated 2.48%, slightly above the Fed’s target for 2% inflation.

The stimulus promises to promote significant demand growth this year. Funding for vaccine deployment will enable consumers to get back to pre-pandemic travel plans, and $1,400 checks per adult will ensure consumers have the funds to make their vacation plans a reality. Gasoline demand, which is tied to consumer trends, will certainly benefit from increased activity. Although diesel demand isn’t necessarily linked to consumer travel, it is tied to broader economy growth, so the US GDP uplift should push diesel demand higher as well. Together, increased demand will help drain inventories and maintain upward pressure on fuel prices.

OPEC released their monthly oil report, which calls for 5.1% global GDP growth in 2021. While that estimate is behind other agencies’ forecasts, it is still enough to undo the estimated 3.7% GDP drop in 2020. Along with economic growth, the group foresees a 5.9 MMbpd increase in demand, with a slow recovery in H1 2021 giving way to robust demand in the second half of the year. Even with strong growth later in 2021, the 5.9 MMbpd growth represents just 60% of 2020’s reduced demand. From an inventories standpoint, the group said OECD crude stocks fell 11 MMbbls in January but remain 125 MMbbls above the 2015-2019 average.

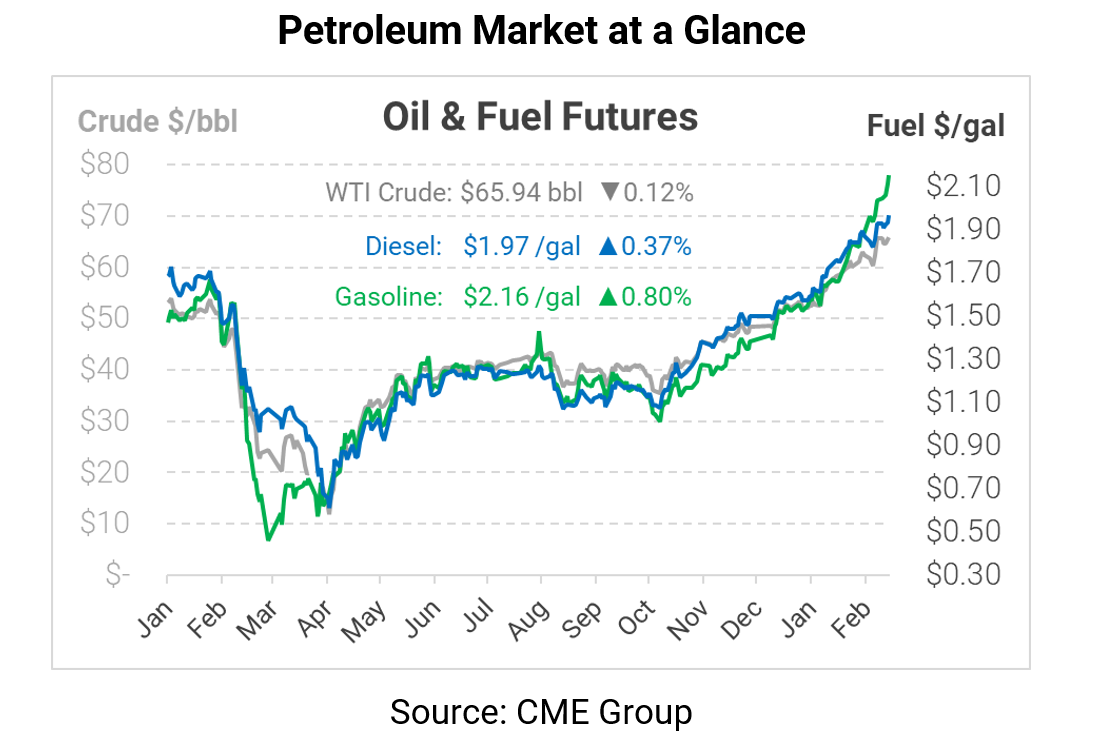

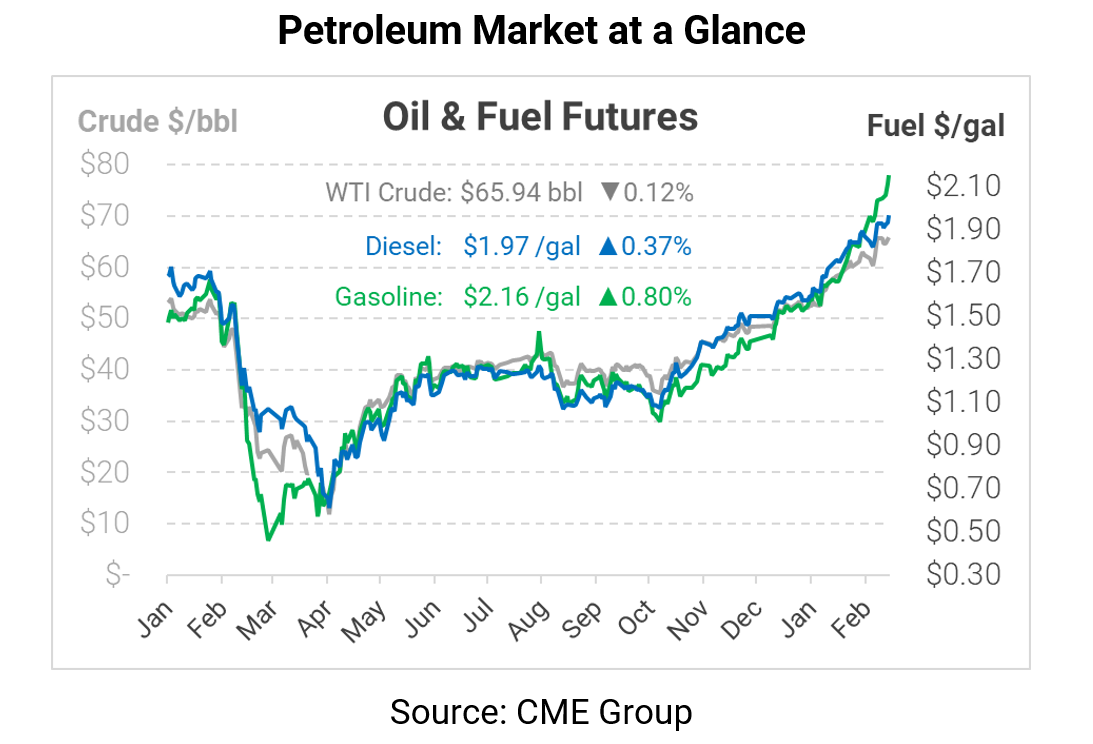

Oil prices are currently flattish, with most of the stimulus rally already baked in. WTI crude is trading at $65.94, down a few cents from Thursday’s closing price.

Fuel prices are moving higher, as continued outages in Texas and stimulated consumer spending combine to push sentiments higher. Diesel is trading at $1.9667, up 0.7 cents from Thursday’s close. Gasoline is trading at $2.1550, leading the market with 1.7-cent gains.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.