Week in Review – February 19, 2021

The week was a short one for oil markets, with traders coming off a long weekened due to President’s Day. Crude oil managed to eke out small gains, but most of the midweek rally faded on Thursday as weather conditions improved in Texas and the US offered talks with Iran. The bullish EIA report was shaken off, viewed as outdated given all that’s unfolded this week.

A weather-induced fuel crisis in Gulf Coast states caused oil markets to rise this week. Snow and ice deep into Texas stopped oil rigs, closed refineries, and overwhelmed power grids. That created Code Red conditions for fuel buyers in Texas, Louisiana, Oklahoma, Arkansas and western Tennessee. Beyond the immediate challenges, the impacts on fueling infrastructure caused prices to soar elsewhere.

As temperatures warm this weekend, crude production will resume, though refiners may take a week or more to fully recover. Given that dynamic, expect crude prices to drop quickly since refiners aren’t

taking in much crude for a while. On the fuel side, prices will fall along with crude, though at a slower rate since refiners aren’t producing much excess fuel.

On Thursday, the US announced its readiness to negotiate with Iran over sanctions and Iran’s nuclear program. Iran has yet to respond, but most expect they will at least attempt to broker a deal. A deal could unleash millions of barrels of Iranian supply onto the market, forcing OPEC to either tighten up quotas or allow prices to go crashing lower.

Prices in Review

Crude oil opened the week on Tuesday at $59.98, on the cusp of trading above $60/bbl. It managed to close above that leve, and climbed to a 13-month high with Wednesday’s closing price. But the soaring prices couldn’t last, and eventually improving market conditions sent prices back towards lower ground. Crude opened at $60.20 on Friday morning, a paltry 22 cent gain.

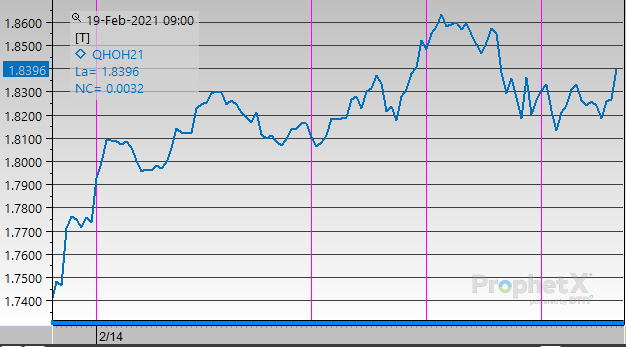

Chilly weather gave support to diesel prices as northern consumers increased their heating oil consumption. Diesel opened the week at $1.7743, climbing midweek and peaking after Thursday showed a large inventory draw for middle distillates. On Friday, it opened at $1.8320, a gain of 5.8 cents (+3.3%).

Gasoline saw the most upward movement this week, buoyed by lost refining production. Gasoline opened the week at $1.7023 but quickly rocketed higher, with nearly 7 cent gains that day. Prices continued rising when the EIA showed an inventory build just half of what the market had expected. Peaking at $1.84, gasoline prices opened on Friday at $1.7855 – a gain of 8.3 cents (+4.9%) for the week.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.