Gasoline Hits 18-Month High

Oil prices continue climbing as the Texas market suffers from wintery weather and devastating power outages. Crude production outages are now over 4 million barrels per day – roughly 40% of US oil production. Given America’s status as an oil exporter, the outage will have international repercussions. Originally expected to last mere days, analysts now believe production could remain offline until this weekend, and a full return might take even longer.

While production is cut off, so is refining capacity. The Gulf Coast is a leading supplier of gasoline to the world, so refining outages there have sent gasoline above $1.80 for the first time since summer 2019. Although gasoline demand has not fully recovered, markets were relatively balanced before this event. Inventories had been rising, but only in a seasonally normal way as refiners stockpiled gasoline ahead of summer demand season. Without the Gulf Coast producing gasoline and shipping it throughout the country, expect inventories to post a sharp reduction next week.

The API’s report last night showed the first signs of wintery weather, with sharp drops in crude and diesel inventories that were double the expected draw. On the flip side, gasoline’s build was also double expectations. The EIA will post its more definitive numbers later this morning. Both the API’s and the EIA’s report measure fuel trends through last Friday, so they do not reflect this week’s market mayhem; those numbers won’t be posted until next Wednesday.

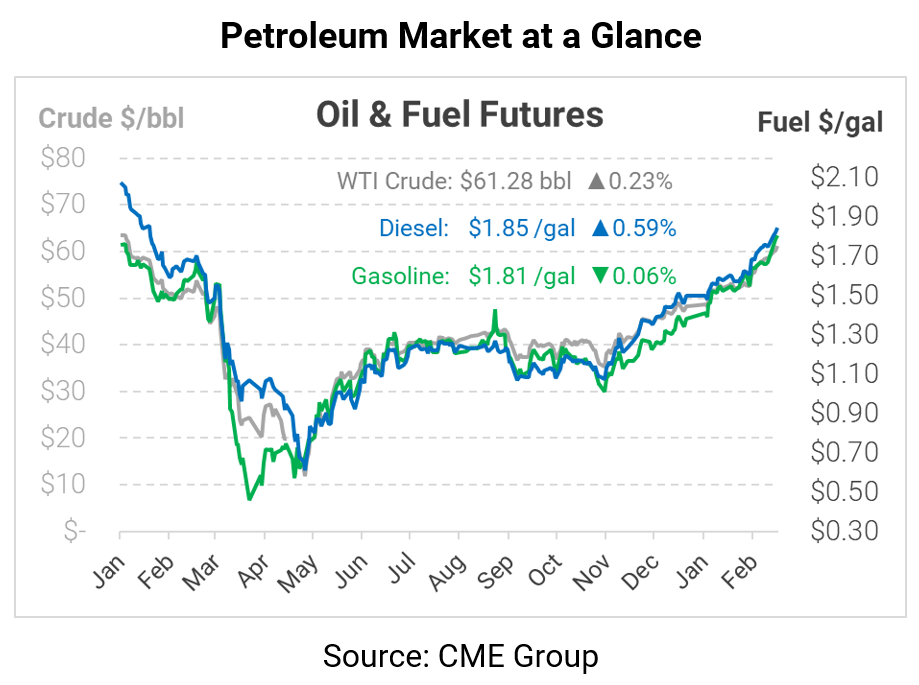

This morning, crude oil is at fresh 13-month highs. WTI crude is trading at $61.28 this morning, up 14 cents from yesterday’s close. Brent crude also traded above $65/bbl at points, though currently it’s just below that level.

Fuel prices are mixed this morning, with gasoline hovering flat while diesel moves higher. Gasoline is currently trading at 1.8485, down 0.1 cents. Diesel prices are $1.8485, a gain of 1.1 cents.

This article is part of Daily Market News & Insights

Tagged: Inventories, Winter Storm

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.