Oil Rally Continues, API Posts Strong Crude Draw

Despite yesterday’s lower trade direction early in the day, the bulls managed to eke out yet another day of gains, bringing WTI crude above $58/bbl. For Brent crude, the rally now stands at nine straight days of growth, which Goldman Sachs points out is the longest streak in two years. So far, it seems nothing can stand in the way of bullish traders expecting good times ahead. We’ll see if today adds yet another gain to the rally. Cold weather in the northern US will also create a draw for heating oil, further propping up both crude and diesel prices.

The API last night reported a sizable crude oil draw, keeping the market supported this morning. Diesel hit near expectations, but gasoline reportedly posted a huge stock gain last week. Keep in mind, though, that seasonal gasoline builds are normal; refiners typically stock up on supplies ahead of the spring and summer demand season. With vaccines expected to be widespread by summer, oil markets are banking on the need to stock up fuel now to supply consumers eager to travel once again.

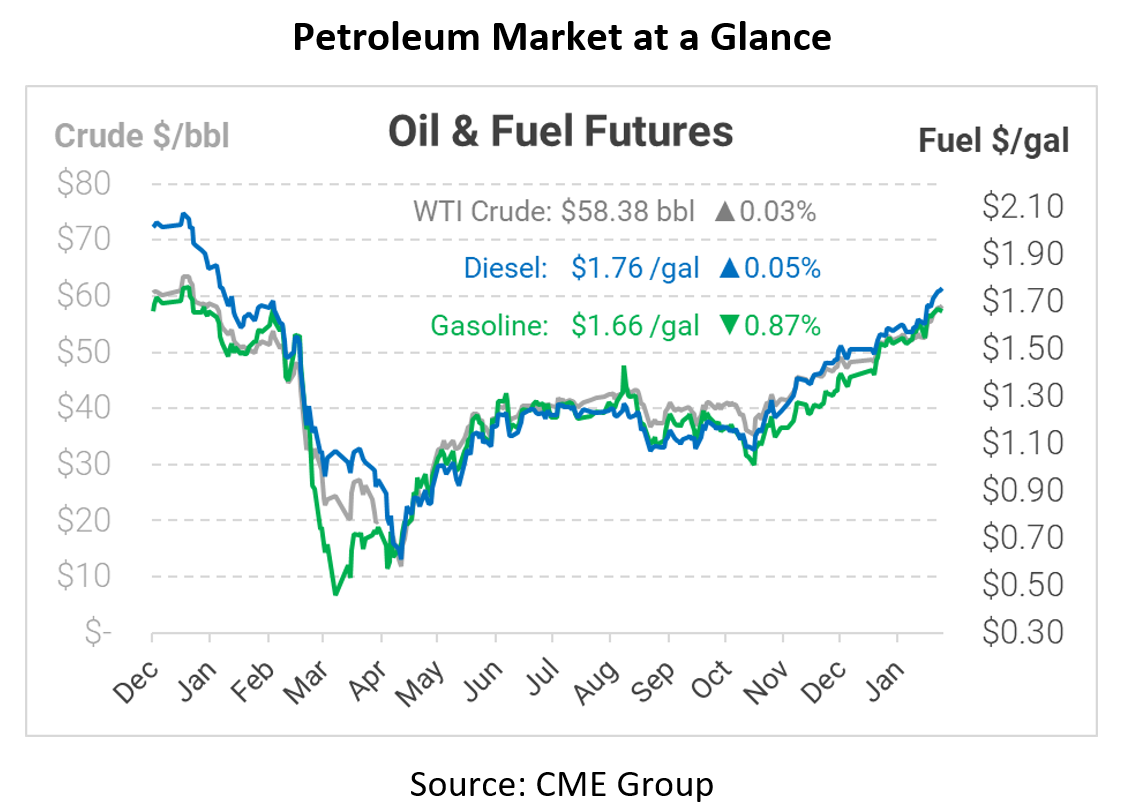

Crude oil is currently trading flat, holding on to yesterday’s gains. WTI crude is trading at $58.38 this morning, pennies off from Tuesday’s closing price.

Fuel prices are mixed today. Like crude, diesel prices are trending flat at $1.7576. Gasoline, on the other hand, is seeing moderate losses. Gasoline prices are $1.6591, down 1.5 cents from yesterday due to the hefty gasoline build.

This article is part of Daily Market News & Insights

Tagged: Inventories

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.